Search News

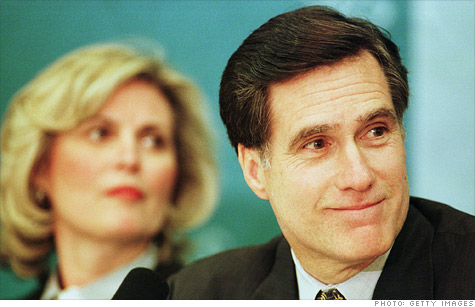

GOP presidential candidate Mitt Romney in 1999, the year he left Bain Capital with an exit package that is taxed more lightly than it would be if he retired from a corporation.

NEW YORK (CNNMoney) -- Working in private equity can be lucrative. But leaving private equity can really pay, as everyone has learned recently from Mitt Romney.

The leading GOP presidential candidate is still pulling in millions from Bain Capital, a private equity firm he founded in the mid-1980s and retired from in 1999.

Of course, it's common for retiring executives to walk away with big retirement packages. But Romney pays only a 15% tax rate on his take, unlike executives at corporations, who typically pay 35%.

Why? Because Romney was a partner in a private equity firm and some of the money he still receives from Bain -- $13 million over the past two years -- is "carried interest."

Carried interest generally represents a share of investment profits paid to a firm's general partners in exchange for the "sweat equity" they contribute by managing the firm's investments.

But it's been years since Romney has even worked at Bain.

And the law suggests that the right to future profits like carried interest must be tied to service to the firm.

So why does he, and other retired private equity managers with similar arrangements, still get carried interest?

The shortest answer is because it's legal, although there's dispute among tax experts about how to interpret some of the relevant legal provisions.

For instance, Section 83 of the U.S. tax code suggests that the granting of a stake in a firm's future profits must be "in connection with the performance of services."

The key phrase -- "the performance of services" -- has been interpreted very broadly. The fact that Romney once provided services to Bain is likely enough.

"The hurdle to jump to fall into that favorable tax rule is very low," said Michael Kosnitzky, who runs the tax practice at law firm Boies Schiller & Flexner and has worked on a number of private equity retirement packages.

Other tax experts say the "service" requirement should be read more narrowly.

"IRS revenue procedures are to be narrowly interpreted, but fund managers seem to be interpreting them expansively to permit whatever is not prohibited," said Lee Sheppard, a tax lawyer who is a contributing editor at Tax Analysts.

The fact that the IRS hasn't challenged that interpretation "may just mean it hasn't come up," she added.

When asked for guidance on Section 83, the IRS told CNNMoney in a statement that "federal law prohibits the IRS from discussing specific taxpayers or specific situations."

Another issue that tax experts debate is a provision that lets a partner who is granted a promise of future profits declare that the grant itself has no income value and therefore isn't taxable.

A key court case found that a "profits interest" was too speculative to value, said Richard Lipton, a partner at Baker & McKenzie.

Other court cases have decided otherwise. But in 1993, the IRS ruled that being granted the right to future profits in a partnership is not taxable if the recipient is a partner providing a service.

Sheppard disputes the notion that the right to future profits can't be valued, however. "It's nonsense," she said. Somebody would be willing to buy a right to future profits, Sheppard argues.

In any case, as the law is interpreted, Romney is well within his rights to receive carried interest long after leaving his private equity firm and to not declare his right to future profits as income.

The Romney campaign, which did not reply to a request for comment, last month released a statement from former IRS commissioner Fred Goldberg, who reviewed the Romneys' tax returns.

"These returns reflect the complexity of our tax laws and the types of investment activity that I would anticipate for persons in their circumstances," he said.

Indeed, Romney's returns raise the kind of tax policy issues that Congress -- if it ever gets around to tax reform -- may choose to debate. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |