Search News

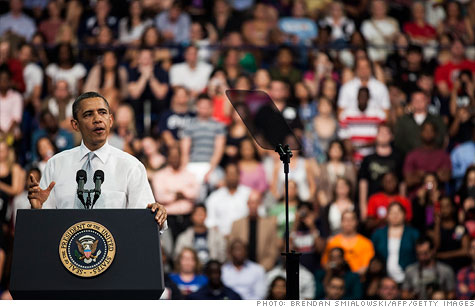

Instead of giving tax cuts to the wealthy, it would be better to invest the money in education, research and health care, President Obama said Tuesday, during a speech to college students in Florida.

NEW YORK (CNNMoney) -- President Obama made a broad push Tuesday for increasing taxes on the wealthy and in particular proposed Buffett Rule.

His address to college students in Florida came on the heels of a White House report that laid out its case, arguing that the Buffett Rule would make the tax code fairer and make it harder for the very rich to lower their tax bills.

"What drags our entire economy down is when the benefits of economic growth and productivity go only to the few ... and the gap between those at the very, very top and everybody else keeps growing wider and wider," Obama said.

The Buffett Rule is a key talking point in Obama's re-election bid. The general principle behind it is that millionaires and billionaires like investor Warren Buffett shouldn't pay a lower percentage of their income in federal taxes than middle-class households.

Obama has even set a threshold for how much they should pay: At least 30% of their income.

Most millionaires today already pay a higher percentage of their income in federal taxes than the vast majority of all Americans. But roughly 25% of them end up with a lower effective tax rate than 10% of middle-income households, according to the Congressional Research Service.

And a very small number -- fewer than 1,500 households in 2009, according to the IRS -- end up owing no federal income tax at all.

Obama's Buffett Rule is targeted specifically at those high-income households that are in a position to structure their income and engage in legal tax strategies to minimize their tax bite.

"The idea behind the Buffett Rule is to have a tax on high-income earners who manage to avoid paying a large share of their income in taxes," Alan Krueger, director of the president's Council of Economic Advisers, said in a call with reporters.

They can do so if much of their income comes from capital gains and dividends -- which are taxed at a lower rate than ordinary paychecks. The same is true if they have made tax-free or tax-sheltered investments.

And a number of other tax breaks on the books end up disproportionately benefiting high-income households.

Krueger asserted that the Buffett Rule would also make for good tax policy by making the tax code more efficient. That is, there would be less incentive for the wealthy to choose one investment or financial activity over another or to recharacterize their income simply to reduce their tax bills.

Tax experts, however, say the goals of the Buffett Rule could be accomplished more simply through a complete overhaul of the tax code.

Indeed, Obama initially proposed the Buffett Rule as a guiding principle for reform. But Senate Democrats are now pushing a bill to implement a version of the rule in today's tax code. And the White House is now endorsing that push.

Tax reform is likely to be a long slog, and implementing a Buffett Rule now would be a "simple and common sense" step toward reform, said Jason Furman, the principal deputy director of the National Economic Council. ![]()

Carlos Rodriguez is trying to rid himself of $15,000 in credit card debt, while paying his mortgage and saving for his son's college education.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: