Search News

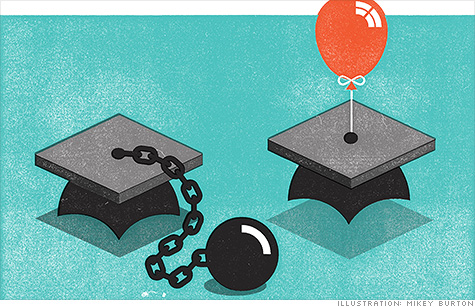

You can get cheap student loan rates for college -- if you know where to look.

(MONEY Magazine) -- In a world of tuition hikes and financial aid shortages, this is what passes for good news: Families who must borrow for college have a growing number of low-cost alternatives to federal loans.

That's especially hopeful given that the last-minute cut in this year's subsidized Stafford rates to 3.4% helps only students with financial "need" -- those who don't qualify are still stuck paying 6.8% (plus 1% in fees).

Among their other options: For-profit lenders such as Sallie Mae and Wells Fargo are marketing parent loans at fixed rates as low as 5.5%.

SoFi, a San Francisco startup, has persuaded alumni at more than three dozen colleges to lend to students at rates starting around 6%.

Plus, several charities, states, and colleges are making lower-rate loans, in some cases as low as 0%.

Where to find low-rate loans

Unfortunately, there's no central clearinghouse. Check out overturemarketplace.com and simpletuition.com for private loans from for-profits and credit unions, but stick to fixed-rate options. (While you can get variable-rate loans as low as 2.25%, the rates are likely to rise at some point.)

For state, charity, school, and startup programs, begin with these lists of low-interest student loans and 0% student loans.

Students should also ask their school's aid office, as well as community organizations like Rotary clubs and religious institutions.

How to make the right choice

Apply for federal loans first so you have that option in your pocket, advises Heather Jarvis, a student-loan attorney.

If you're lucky enough to win a cheaper loan, read the fine print. Bargain loans may require borrowers to max out federal student loans first, have co-signers, or make payments during school.

Also, weigh the rate against the benefits of the federal loan.

You may find the Stafford's income-based repayment and public-service forgiveness options are worth paying for. Finally, don't use cheap loans as an excuse to overborrow: Students should keep total college debt below their expected first-year salary. ![]()

Carlos Rodriguez is trying to rid himself of $15,000 in credit card debt, while paying his mortgage and saving for his son's college education.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: