Search News

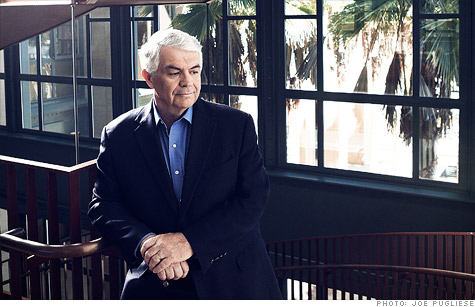

Stanford University's John Taylor helped invent modern monetary policy. These days he's no fan of the Fed's stimulus moves.

(MONEY Magazine) -- You needn't look hard to see the contrast between presidential candidates when it comes to what role Washington should play in reviving the economy.

Stanford University economist John Taylor has spent decades looking to answer that question, in theory and practice. Taylor, 65, has worked for four Presidents -- Ford, Carter, and both Bushes -- and is advising Mitt Romney's campaign.

A senior fellow at the conservative Hoover Institution, he created the influential "Taylor rule," which posits how central banks should target interest rates in response to inflation and economic output.

Today Taylor is harshly critical of some of the stimulus policies pursued by the Federal Reserve and the younger Bush and Obama administrations.

He argues that short-term attempts to juice the economy lead to higher unemployment and slower growth, a case he makes in his recent book, "First Principles: Five Keys to Restoring America's Prosperity."

Taylor spoke with contributing writer Janice Revell. Their conversation was edited.

The concept of predictability is a major theme in your book. Why is it so important?

Unpredictable economic policy -- short-term stimulus packages, temporary tax rebates, and stop-and-go monetary policy -- is the main cause of our abysmal recovery. Economic growth has averaged 2.4%, compared with 5.9% after the most recent severe recession, from 1981 to 1982.

Start with fiscal policy. After the recession began, Presidents Bush and Obama felt a need to "do something." Their approaches differed, but both chose classic Keynesian stimulus policies.

It didn't work. My own research showed Bush's temporary tax rebate in 2008 had no discernible effect on the economy. Nor did Obama's $800 billion stimulus plan in 2009, which included tax rebates, increased federal spending, and grants to states for infrastructure projects.

The stimulus increased the federal debt burden and created uncertainty about what was next for taxpayers.

What is the proof for this failure?

Households mostly saved the stimulus money instead of spending it. Even where there was a temporary boost to consumption, my research found it didn't aid the recovery.

Take the Cash for Clunkers program, which offered consumers an incentive to buy a new car. People who were planning to trade in their old car anyway turned it in a few months earlier. So there was a blip in new-car sales, followed by a decline.

The money sent to the states, meanwhile, didn't really increase infrastructure spending. If a state already had a light-rail project under way, it just borrowed less and used some of the federal money instead -- you didn't see more light-rail projects.

What about the argument that things would have been worse if there had been no stimulus?

The models that suggest this are the ones that said in advance stimulus would work. Again, look at where the money went. It went to consumers. Then look at what households did when they got the money. The answer is, not much.

When asked this question, I sometimes tell a personal story.

Several years ago my wife got me new golf clubs for my birthday. I was all excited that this was going to be a real stimulus to my game. So a few years have gone by, and my game is just the same as ever. I didn't want to make my wife feel bad, so I said, "Look, if you hadn't gotten me these clubs, my game would have gotten a lot worse."

You highlight in your book a memo written in 1980 to President-elect Reagan by economists who had worked on his campaign. What is its relevance today?

That memo outlined long-term reforms for tax, monetary, and regulatory policies. There were no temporary tax rebates or other short-term stimulus proposals. It was strategic and focused on policy predictability.

Compare that to a memo written to President-elect Obama in 2008 by his economic team. That memo was focused on short-term interventions. The contrast is striking.

But wasn't Reagan facing a much less chaotic environment?

It's difficult to recall now the severity of the U.S. economic slump when Reagan took office. We had double-digit inflation, interest rates were near 20%, unemployment was high, and credit controls had been imposed.

What's your assessment of the Federal Reserve's recent actions to help spur the economy?

The Fed has engaged in extraordinarily loose monetary policy, including two rounds of so-called quantitative easing.

These large-scale purchases of mortgages and Treasury debt were aimed at lifting the value of those securities, thereby bringing down interest rates. I believe quantitative easing has been ineffective at best and potentially harmful.

Harmful how?

The Fed has effectively replaced large segments of the market with itself -- it bought 77% of new federal debt in 2011, my calculations show. By doing so, the Fed has created great uncertainty about the impact of its actions on inflation, the dollar, and the economy.

The existence of quantitative easing as a policy tool creates uncertainty, as traders speculate on whether and when the Fed is going to intervene. It's bad for the U.S. stock market, which should reflect the earnings of corporations.

You believe the Fed's mission needs to be changed.

The Fed needs to focus on a single goal of long-run price stability. We should remove the Fed's dual mandate of maximum employment and stable prices, which was put into effect in the 1970s.

From 2003 to 2005, the Fed held interest rates too low for too long. A primary reason was its concern that raising rates would increase unemployment.

The unintended consequence was that low rates fueled the housing bubble, which in turn led to the recession and high unemployment.

More recently, the Fed has cited concerns over employment to justify its interventions, including quantitative easing. Removing the dual mandate would take away that excuse.

On the regulation front, what would you do with Dodd-Frank, the 2010 Wall Street reform act?

I would repeal almost all of it. The problem with Dodd-Frank is that it gives the Federal Deposit Insurance Corp. the authority to take over and possibly liquidate any financial firm.

It's taking established bankruptcy law and assigning that power to government officials, who have the ability to favor certain firms over others. That actually increases the likelihood of a bailout.

Should the big banks be broken up then? That could eliminate the need for Dodd-Frank.

The best solution is to require adequate capital at banks and other financial firms, to enforce the risk regulations that are, and were, on the books, and to replace the orderly liquidation authority of Dodd-Frank with a bankruptcy code that applies to these large firms so they are not bailed out. It is too much risk taking with taxpayer money that is the problem.

See also:

The bailout that bruised capitalism

Tax facts: Half of us really don't pay up?

The not-so-great and powerful Ben Bernanke

Two-thirds of Dodd-Frank still not in place ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |