Just how big is the federal debt?

Depends what you mean by "debt."

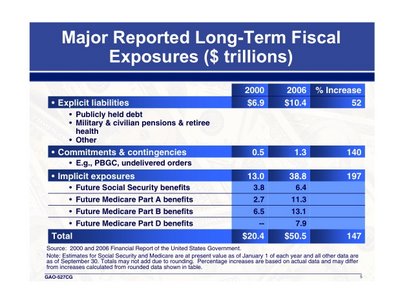

60 Minutes ran a Steve Kroft report last night about David Walker, the comptroller general of the United States. Basically, he's our accountant. Walker has been traveling the country warning that we're headed for a fiscal meltdown. In response, economist Dean Baker, blogging for the liberal journal American Prospect, unleashes his fists of fury: 60 Minutes declared war tonight on Social Security and Medicare.... [I]f they wanted to be accurate, the 60 Minutes crew could have pointed out that almost the whole horror story is driven by projections of exploding health care costs, not "entitlements" for the elderly (e.g. Social Security). As is clear to anyone who is moderately competent at arithmetic, the projected budget problems are due to a projected explosion in health care costs, not demographics. If U.S. health care costs were more in line with those in any other wealthy country, there wouldn't be much of a budget crisis to talk about.I missed the show tonight, but if the web version of the story is any reflection of what viewers saw, the 60 Minutes crew actually does say that health care is the 800 lbs. gorilla here: Part of the problem, Walker acknowledges, is that there won't be enough wage earners to support the benefits of the baby boomers. "But the real problem, Steve, is health care costs. Our health care problem is much more significant than Social Security," he says.So Baker and Walker agree, I think, that the way we pay for health care is basically ridiculous and that we can't afford to sustain our current spending patterns. The question is, what do we call this problem? Is this a fiscal crisis? Or a health care crisis? This sounds like an abstruse philosophical debate, but it has enormous political and practical implications.  If you add the projected cost of future Medicare benefits to the basic federal debt and other obligations, you get some mind-bogglingly big numbers--in the neighborhood of $50 trillion. (See the slide from one of Walker's talks at left.) That's one way to ring the alarm bell, I suppose. Maybe all this bankruptcy talk will eventually get voters and policymakers focused on fixing the health care system, so that those projections don't come true. If you add the projected cost of future Medicare benefits to the basic federal debt and other obligations, you get some mind-bogglingly big numbers--in the neighborhood of $50 trillion. (See the slide from one of Walker's talks at left.) That's one way to ring the alarm bell, I suppose. Maybe all this bankruptcy talk will eventually get voters and policymakers focused on fixing the health care system, so that those projections don't come true.But talking about this primarily as an accounting problem--too much going out, not enough coming in--can confuse as much as it clarifies. The government could, in theory, solve most of its balance sheet woes by simply phasing out the Medicare program. But this country would still have a health-care financing mess. That's Baker's point. So should we just call it a health care crisis? More on that in The Social Security Trust Fund is full of IOUs backed by the US Treasury. If the federal government pays back that money with a fair interest rate Social Security will not be broke in a few years.

CNNMoney.com Comment Policy: CNNMoney.com encourages you to add a comment to this discussion. You may not post any unlawful, threatening, libelous, defamatory, obscene, pornographic or other material that would violate the law. Please note that CNNMoney.com makes reasonable efforts to review all comments prior to posting and CNNMoney.com may edit comments for clarity or to keep out questionable or off-topic material. All comments should be relevant to the post and remain respectful of other authors and commenters. By submitting your comment, you hereby give CNNMoney.com the right, but not the obligation, to post, air, edit, exhibit, telecast, cablecast, webcast, re-use, publish, reproduce, use, license, print, distribute or otherwise use your comment(s) and accompanying personal identifying information via all forms of media now known or hereafter devised, worldwide, in perpetuity. CNNMoney.com Privacy Statement.

|

|