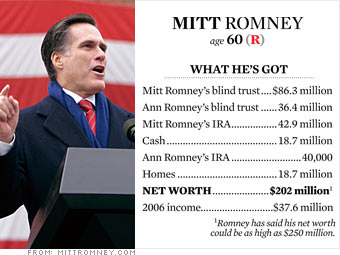

Net Worth: $202 million

Where he got it

Romney won a combo M.B.A. and law degree from Harvard and promptly took himself to Wall Street, or at least the Boston version.

He started with the Boston Consulting Group and moved on to Bain & Co., another consulting firm, where he became vice president in 1978.

Six years later he founded Bain Capital, a private equity spin-off that at one time or another had stakes in Bright Horizons, Domino's Pizza, Staples and The Sports Authority, among others. Romney still receives income from Bain as a retired partner but no longer has any say in operations.

Since 1999, when Romney entered public life, taking over the troubled operations of the 2002 Salt Lake City Olympics, and later as Governor of Massachusetts, he has donated his public service salaries to charity.

He has said he would do the same with his presidential earnings. He doesn't need the small change.

Where it goes

Romney and his wife Ann hold about 100 stocks, including Dell, Disney and Target, as well as foreign issues including the Bank of Yokohama and China Mobile, in two blind trusts.

About 43 percent of the Romney portfolio is tied up in private equity investments through Bain Capital Management. About $38 million is in Federal Home Loan Bank bonds that have maturities stretching out to 2016.

Last year Romney's adviser sold dozens of stocks, some of which he believed would be politically sensitive.

Among them: gaming companies such as Bally and Harrah's, and companies that do business with Iran, including European oil producers Eni SpA and Total. The sales explain Romney's ultrahigh 2006 income.

How he could do better

Romney is the candidate with the most riding on the estate-tax debate. Hugh Smith and Stewart Welch of the Welch Group say that unless Congress changes laws, Romney's estate could owe at least $90 million as of 2011.

They suggest various ways to cut that bill, including giving all the money to the family foundation after Mitt and Ann both die.

A smaller bite out of the problem: They could give $24,000 tax-free to each of their grandchildren, soon to number 12, every year.