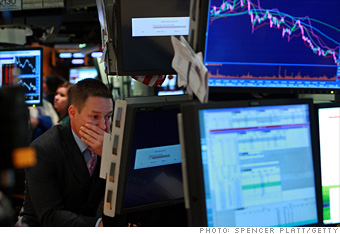

In the worst day on Wall Street in seven years, the Dow Jones industrial average tanked more than 500 points after Lehman Brothers' epic collapse of the buyout of Merrill Lynch

By Monday night, AIG was in fact hit with a downgrade, as Fitch bumped the insurance group down a notch. With $1.1 trillion in assets and 74 million clients in 130 countries, investors feared AIG's collapse would severely hurt consumers and further tighten already strangled credit.

Also Monday, news cropped up that the nation's largest savings bank, Washington Mutual was in search of a white knight.

NEXT: Tuesday, Sept. 16 - The Fed steps in