ETF investing done right

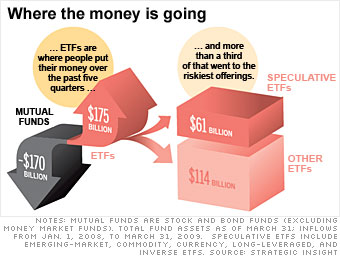

Money is pouring into exchange-traded funds. They can help your portfolio recover, if you choose the purest kind.

Invented 16 years ago as basic index funds that trade on the market like stocks, they can give wide diversification in the U.S. and abroad at rock-bottom cost. And index ETFs are usually a hair cheaper than their mutual fund equivalents (though not so much cheaper that you should dump index funds to switch). You pay a commission on each trade, so ETFs aren't an ideal place to sock away small amounts of money each month. But they're perfect if you're investing a lump sum, such as an inheritance or a 401(k) rollover.

The catch is that Wall Street has been muddying the waters. In the past couple of years financial engineers have rolled out hundreds of new kinds of ETFs, and investors have piled into the most speculative. "If you don't understand how these funds should be used, you can lose a lot of money," warns Jim Wiandt, publisher of IndexUniverse.com.

For most small investors, the best ETFs are the purest. Here's how to zero in on them - and avoid the rest.

NEXT: 1. Stick with the old reliables