NEW YORK (CNN/Money) -

It's inevitable.

That was how most Wall Street analysts summed up Oracle's chances of finally acquiring rival software maker PeopleSoft after PeopleSoft's board canned CEO Craig Conway Friday and the Justice Department said it would not appeal a federal judge's ruling tossing its attempts to block Oracle's bid for PeopleSoft.

The first bombshell, the latest twist in the nearly 16-month long hostile takeover battle, seems to pave the way for a deal since Conway, a former Oracle sales executive, was adamantly opposed to a merger with his former employer.

PeopleSoft founder and former CEO Dave Duffield, who Conway succeeded in 1999, was named the new CEO. And although PeopleSoft executives said during a morning conference call that Conway's dismissal was not related to the Oracle takeover situation, several analysts said they didn't believe that.

Duffield is so admired by employees and customers at PeopleSoft that his nickname is "Dad," said Trip Chowdhry, an analyst with FTN Midwest Research.

That means Duffield is much more likely to hammer out a friendly deal with Oracle Chairman Larry Ellison that's better for PeopleSoft customers and employees than Conway would have been able to do, Chowdhry said.

Chowdhry also noted the board had named PeopleSoft director Aneel Bhusri as vice chairman -- a telling sign since Bhusri is a venture capitalist.

"There are now rational people at PeopleSoft to make sure everyone's interests are taken care of," Chowdhry said. "Duffield can deal with Oracle on employees and customers while Bhusri can negotiate with Oracle to raise the bid. He knows about exit strategies."

Oracle may need to raise its offer

To that end, Wall Street is clearly betting that Oracle would need to raise its bid. Shares of PeopleSoft (PSFT: Research, Estimates) surged nearly 15 percent Friday afternoon to trade about 8 percent above Oracle's $21-a-share all-cash offer.

|

|

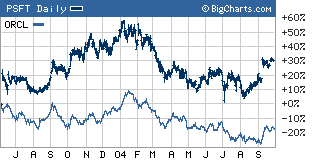

| Shares of Oracle have taken a beating during the 16-month hostile takeover battle for PeopleSoft. |

PeopleSoft's stock gains accelerated Friday afternoon after the Justice Department said it would not appeal a federal judge's ruling last that it hadn't proven its case that an Oracle-PeopleSoft combination would violate antitrust law.

"If the DOJ were to appeal, this would have dragged the case on even longer regardless of what the companies wanted to do. We're not in legal limbo anymore. The dominos are falling," said David Hilal, an analyst with Friedman Billings Ramsey.

PeopleSoft also said Friday it would report stronger-than-expected software license revenue in the third quarter, a sign PeopleSoft may be winning more deals than Oracle in lucrative application software -- software that helps large corporate customers automate routine business tasks.

|

|

| Larry Ellison may be one step closer to finally winning PeopleSoft's hand in corporate matrimony. |

Combine that with the management changes and it seems that PeopleSoft is sending this message to Oracle: We're available but you've got to up the ante.

"Everything PeopleSoft announced this morning helps clear the way to begin negotiations and maybe consummate the merger," said Hilal. "The license revenue is much better than expected and that gives PeopleSoft a position of leverage."

But it remains to be seen how strong PeopleSoft's hand really is. Patrick Mason, an analyst with Pacific Growth Equities, points out that PeopleSoft only commented on its third-quarter license numbers, not overall sales and earnings.

Oracle probably doesn't need to decide what to do with its offer until PeopleSoft comments about what it expects in the fourth quarter -- something PeopleSoft is likely to do that when it reports its third quarter results later this month.

| Software showdown

|

|

|

|

|

"It all depends on guidance for the fourth quarter. If it isn't that exciting, then Oracle maybe doesn't have to raise its bid," Mason said.

That could partly explain why Oracle's stock also rose sharply on the news of Conway's departure. Oracle (ORCL: Research, Estimates) gained nearly 6 percent. Typically stocks of companies that are about to make an acquisition generally fall on concerns about the impact the deal will have on earnings, as well as worries about integration issues.

But Matthew Kelmon, president of Kelmoore Investment Co., which owns Oracle in several mutual funds, said Wall Street might just be relieved that a deal might finally be closer to taking place. The merger melodrama dragging on for more than year has been a significant headache for Oracle shareholders.

Kelmon said an Oracle-PeopleSoft combination would also strengthen Oracle's position in the application software market, an area where Oracle has struggled against PeopleSoft and industry leader SAP.

Software shakeout expected

But not everyone was convinced that PeopleSoft is willing to give up the fight just yet. Donovan Gow, an analyst with American Technology Research, said it's hard to believe that Duffield would return to the top job of PeopleSoft just to sell the company he founded.

| �* as of mid-day on 10/1/04 | | �Source:��CNN/Money |

|

"Duffield is the founder and former CEO so he, more than anyone, is the person associated with PeopleSoft. I'm not certain that he's going to roll over and say that PeopleSoft being taken over is the best thing. It's his baby," Gow said.

Along those lines, Richard Williams, an analyst with Garban Institutional Equities, said he wouldn't be surprised it Duffield turns the table on Oracle and tries to make another acquisition in order to fend off Oracle. He said BEA Systems, long mentioned as another possible Oracle takeover target, could be a good fit.

And other obstacles remain, even if the two companies agree to a friendly takeover.

The European Union's antitrust arm is still reviewing the deal. Analysts think the EU is likely to greenlight the merger, especially now that the DOJ has decided to stop fighting it. But the EU has not always followed the lead of the U.S. when it comes to merger approvals.

Nonetheless, Wall Street is banking on a deal getting done at some point. Investors clearly expect a long-overdue wave of consolidation in the software sector.

"This would clear the way for other software mergers to take place," Kelmon said.

With that in mind, shares of BEA and other perennial software takeover candidates such as Siebel Systems and Sybase all jumped Friday.

Analysts quoted in this story do not own shares of the companies mentioned and their firms have no banking relationships with the companies.

|