|

Ethanol fueling growth for ADM

Stock Spotlight: Corn may soon be a common ingredient in car engines -- how much will no. 1 ethanol producer Archer Daniels Midland benefit?

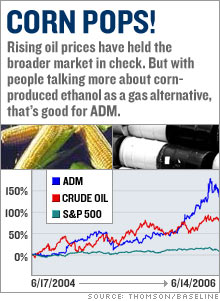

NEW YORK (CNNMoney.com) - Soaring gas prices had to be benefiting somebody other than the big oil companies. Turns out that it's agriculture giant Archer Daniels Midland. For years a powerhouse in food and beverage additives, ADM's stock has shot up this year because it's the nation's largest producer of the corn-based fuel ethanol. With gas at around $3 a gallon, more are talking about using ethanol as an alternative to gas and that has ADM investors excited.

But there's more to ADM than ethanol. ADM's other businesses, including the production of high-fructose corn syrup for sodas, are no slouches either. Third-quarter profits in ADM's oilseed and sweetener and starch divisions soared from a year ago, helping the company to post a 29 percent increase in earnings overall. With that in mind, shares of ADM (Charts) are up more than 60 percent through mid-June, making them the third best performer in the S&P 500. But competition is expected to heat up as more ethanol producers go public. VeraSun Energy debuted on June 14 and it stock surged 30 percent on its first day of trading. Two other ethanol producers have filed to go public as well. So is it too late to cash in on the ethanol craze? Ethanol fueling ADM...and competition

Rising gas prices have thrust alternative energy into the spotlight. As part of the Energy Policy Act of 2005, the government has mandated ongoing increases in the amount of biofuels mixed with gasoline each year until 2012. That should turn the ethanol business from an also-ran into a contender over the next seven years. ADM is looking to take advantage of this. Last September, ADM announced that it would build two new ethanol plants, expanding its capacity by 500 million gallons. But ethanol production had been surging even before the government stepped in. Demand doubled over the past four years to an estimated 3.7 billion gallons in 2005, according to a fact sheet from ADM competitor Pacific Ethanol (Charts). This trend is expected to continue. "A certain amount of growth in the ethanol market is set in stone because of the government mandate to use more biofuels," said Spencer Kelly, Ethanol & Biodiesel Editor at Oil Price Information Service. "But most people estimate that production will expand beyond what is mandated by law." Ethanol prices are currently $3.70 a gallon, but analysts warn that prices probably won't remain so high since it's relatively easy to make the fuel. Plus, this is not an industry with high barriers to entry and competition should become more intense. In addition to VeraSun Energy (Charts), ADM competitors Hawkeye Holdings and Aventine Renewable Energy are all looking to go public this year in order to raise cash they'll need to ramp up their production capacity. "Why are all these companies having IPOs this year? Because ethanol margins are at a very attractive level right now," says Michael Judd, who covers Pacific Ethanol for Greenwich Consultants. "That's not to say that they'll be the same in a year with all the production increases." ADM has said it believes that industry wide ethanol production capacity will grow to 6.5 billion gallons within the next two years, which will certainly narrow profit margins. Sowing many seeds

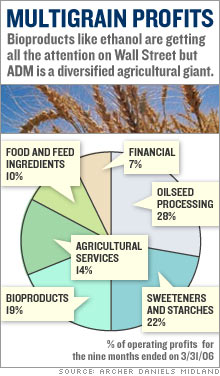

What many analysts see when they look at the ethanol market is a huge heap of risk. But ADM's biofuels division, which includes ethanol production, made up only 19 percent of its operating profits during the first three quarters of this fiscal year. So clearly the company has much else to offer investors. ADM makes a lot of other things from corn besides ethanol, including high-fructose corn syrup, corn starch and sweeteners. The company's sweeteners and starches business contributed about 22 percent to overall operating profits so far this year. And analysts see more growth for other corn products ahead. The North American Free Trade Agreement (NAFTA) is easing restrictions on corn syrup, so ADM's market share in Mexico is expected to grow sizably, according to research from Citigroup. The company's oilseeds division - including soybeans, canola, flaxseeds, and sunflower seeds - also saw a big bump in the third quarter. Oilseeds processing has benefited from improved global market conditions in fiscal year 2006, sending profits up nearly 50 percent so far this fiscal year. With facilities on six continents, and its feet planted mostly in major staple markets, ADM is no fly-by-night fuel producer. While the ethanol market could take a hit, it is unlikely for corn, soybeans, wheat, cocoa and other crops to bottom out simultaneously. Less risky than ethanol pure plays

As long as ethanol remains in the headlines, investors will likely consider ADM as one of the best ways to capitalize on the trend. "A lot of people invest by theme, and if they're interested in the ethanol theme, we think they're going to be attracted to ADM's stock," said Don Hodges, chief investment officer at the Hodges fund, which owns shares of ADM. "We see this creating additional demand for the stock and supporting prices." But Greenwich Consultants' Judd thinks that ethanol companies may be an overly risky choice for individual investors since so much of their success will depend on volatile commodity prices. ADM shares are currently trading at nearly 21 times projected earnings for fiscal 2006, which at first blush doesn't seem that pricey. But to put that in perspective, other agricultural firms such as Bunge (Charts) and ConAgra Foods (Charts) trade at just 13 and 16 times 2006 earnings estimates. Still, Hodges thinks the stock is a good value and that because ADM is more than an ethanol producer, the company should hold up even in a rough market. "You lower your risks substantially with ADM because they've already got other good businesses. I think now's actually a good time to buy," he said. ________________________ Related: Sorting through the ethanol hype Related: Even bullish investors wary of ethanol

Analysts quoted in this story do not own shares of Archer Daniels Midland. Citigroup has a banking relationship with ADM. The Hodges Fund owns shares of Archer Daniels Midland. |

|