Martha, and Marvel and Malone, oh my!Media Biz hit the jackpot with its Martha Stewart Living Omnimedia, Marvel and Liberty Media stock picks. But we'd prefer to forget Live Nation, IMAX and XM.NEW YORK (CNNMoney.com) -- It has been a great year for many media stocks. So, not surprisingly, it's been a pretty good year for guys like me, who make a living writing about media companies and their stocks. This column's stock-picking record is pretty good this year. With a couple of exceptions, shares of the companies that I recommended have done well, and the select few that I panned have, in fact, gone down. Here's a closer look at Media Biz's hits and misses, an exercise I like to refer to as self-congratulation/self-flagellation.

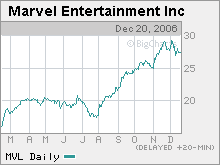

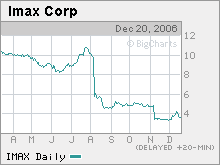

First, it's time to crack out the whip. One of my worst picks of the year, by far, was the column's first. (At least I got it out of the way early.) Way back in January, I wrote an extremely negative column about the prospects of Live Nation, the concert promotion company that had just been spun out of radio firm Clear Channel Communications. I argued that it would be tough for the stock to do well, given the moribund state of the music industry. Wrong! The stock's up 63 percent since then. Fortunately, my track record improved quickly, and visions of a successful career as a hedge fund manager started to dance in my head. In February, I touted Univision (before private equity firms agreed to buy the Spanish-language broadcaster) and independent film studio Lionsgate (before "Crash" won the Oscar for best picture). Shares of Univision are up 11 percent, while Lionsgate's stock has gained 13 percent. Two picks from later in February have done even better. I went against the herd and made contrarian "buy" recommendations on Martha Stewart Living Omnimedia and Marvel, arguing that both stocks had bottomed out and that earnings would improve heading into 2007. Well, Martha, my dear, you have been my inspiration. Shares of the domestic doyenne's media firm have shot up 33 percent since mid-February. And Marvel (Charts) has been a heroic (couldn't resist) performer, with the stock soaring 72 percent since late February. Now where did I put that hair shirt? My next pick, of movie theater operator Imax, was an even more boneheaded call than my panning of Live Nation. IMAX put itself on the shopping block in March, and I argued that Sony or my parent company, Time Warner, could be interested in buying. Turns out, though, that there was very little interest in very big screens. IMAX took down the "For Sale" sign last week. And the company, which is expected to lose money this year and next, has been a woeful performer. Shares have plunged 65 percent since late March. Things took a turn for the better in the spring and summer, however. Another contrarian pick, of newspaper publisher E.W. Scripps in late March, turned out well. I argued that investors were focusing too much on the slow-growth newspaper business and not enough on Scripps's sizzling cable channels, such as the Food Network. The stock is up 14 percent. Speaking of cable, a bullish call on Comcast, the nation's largest cable provider, has been a great pick. Comcast (Charts) has surged nearly 50 percent since I touted it in late April. One of this column's few "sell" recommendations has also worked out moderately well. I argued in May that Netflix (Charts) was a great company but an overvalued one. Shares are down 5 percent since then. My faith in media mogul John Malone has also been rewarded. I wrote a column in May suggesting that both tracking stocks for his Liberty Media conglomerate would do well. And indeed they have. Shares of Liberty Capital, which tracks the performance of cable networks Starz and Encore as well as investments in major media and telecom firms, are up 21 percent, while those of Liberty Interactive, which tracks Malone's investments in QVC, online retailer Provide Commerce and other digital assets, are up 25 percent. I called CBS (Charts) a Cheap Broadcasting Stock in May, and that turned out to be prophetic. Shares of the broadcast company have surged 27 percent since then. I also went out on a limb to predict that shares of my parent company would finally join the media rally since the company was planning on a much-needed overhaul of AOL. To my delight, Time Warner's (Charts) stock has in fact rallied. Shares are up 37 percent since my column in late July. A victory for the home team at long last. The music hasn't been so sweet for a former member of the Time Warner family. Shares of Warner Music Group have sunk 20 percent since late July, after talks to merge with rival EMI collapsed because of regulatory concerns. But I called it. I wrote, one day before a European court decision overturning the merger that created music firm Sony BMG cast doubt on whether EMI and Warner could ever merge, that investors were incorrectly assuming that a combination was a done deal and that if talks fell apart, Warner Music's stock was vulnerable for a big pullback. A similarly negative call on XM Satellite Radio (Charts) has not turned out so well. I wrote in late July that the company could be an intriguing takeover target but that stock could struggle in the near term owing to concerns about slowing subscriber growth. Well, I got that one kind of right ... but also very wrong. There has been more chatter about a possible XM-Sirius Satellite merger. But the stock hasn't struggled. Partly thanks to takeover speculation, the stock has rebounded 53 percent. And the jury's still out on my final official pick of the year, newspaper publisher Tribune. I wrote in August that Tribune (Charts) may need to either break up or put itself up for sale. The company is now considering a sale of individual assets or perhaps the entire company. But nothing appears imminent, and the stock is up just 1 percent since my column. After late August, I focused more on media rants (i.e., the stupidity of the "Heroes" Insinkerator lawsuit and the poor quality of "Monday Night Football" telecasts) and less on stock picking. But I did say in a column analyzing the takeover prospects of online music firm Napster that investors should be wary. I said Napster could be in trouble if the company, which put itself on the block in September, fails to find a buyer. And since that column ran in early October, Napster is still independent and the stock has fallen more than 20 percent. So that's that. I suspect that 2007 will be another interesting one for media stocks, and this column will have its fair share of picks and pans. Or will it? I'm starting to get the sense that by this time next year, there will be no need to look at media stocks anymore since just about every public media company will succumb to the urge to sell out to Apollo, Blackstone, Thomas H. Lee or any of the other private equity firms that have gazillions in cash and intense interest in scooping up media assets. Although something tells me that Google should be able to resist the clarion call to go private.

The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

| |||||||||||