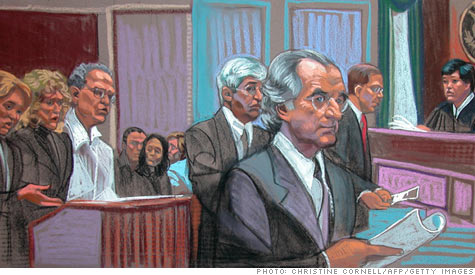

Bernard Madoff, mastermind behind the biggest Ponzi scam ever, was sentenced to 150 years in federal prison.

Bernard Madoff, mastermind behind the biggest Ponzi scam ever, was sentenced to 150 years in federal prison.

NEW YORK (CNNMoney.com) -- Most of Bernard Madoff's victims have two things in common: a) they'd never heard of the Ponzi schemer before he was arrested nearly two years ago and b) they're not eligible to get any of their money back.

That's because the majority of Madoff's victims did not invest directly in his firm. They invested in third-party feeder funds, and therefore don't qualify for the financial protections extended to direct investors.

"I think it's grossly unfair," said Peter J. Leveton of Boulder, Colo., who counts himself as one of the more than 200 "indirect investors" who lost money to Agile Funds, a feeder fund for Madoff. "Virtually none of the Agile investors knew that any portion of our money was going into the Madoff organization."

So far, 16,394 claims have been filed by investors who claim to have lost money in Madoff's Ponzi scheme, according to the office of Irving Picard, the trustee appointed by federal bankruptcy court to recover and distribute stolen assets.

The majority of the claims -- 13,054, or nearly 80% of the total -- have been denied, according to the trustee. Most of these denied claims -- some 10,299 -- were shot down because the claimants are considered "third party" investors that put their money into feeder funds, rather than directly in Madoff's firm.

This detail is essential in getting money back from the seized assets, or in becoming eligible for insurance coverage from the Securities Investor Protection Corp., the organization that restores lost assets to investors burned by bankruptcy or fraud.

"The third party folks did not have an account with the Madoff brokerage firm," said SIPC Chief Executive Steve Harbeck. "They invested in some other entity that opened an account with the Madoff firm. That entity is a customer and will get whatever it's entitled to."

So while the feeder funds could be eligible for financial protection from SIPC, their investors are not.

Kenneth Springer, a certified fraud examiner and former special agent of the Federal Bureau of Investigation, said this is a case of caveat emptor -- let the buyer beware.

"When you go to a feeder fund, it's up to you to make sure that they're doing what [you] think they're doing," said Springer, president of Corporate Solutions and co-author of "Digging for Disclosure: Tactics for Protecting Your Firm's Assets from Swindlers, Scammers and Imposters."

"There's a whole lot of things that should have been uncovered by the feeder funds," he said. "But unfortunately with Madoff, you didn't see as many red flags as you did with Allen Stanford and other [alleged Ponzi scammers]."

SIPC provides a line of protection of up to $500,000 to eligible investors who lost money. The trustee has declared 2,355 investors to be eligible for more than $766 million in SIPC funds. This averages to about $325,000 per eligible investor.

SIPC-eligible investors who lost more than $500,000 must reclaim the rest of their damages from assets seized from Madoff's estate.

But they're unlikely to get all of their money back. So far, the trustee has recognized about $5.1 billion in claims that fit this description -- more than triple the amount of recovered assets that would be used to compensate them. About $1.5 billion of Madoff's estate has been recovered so far, according to the trustee. These assets will be awarded pro rata -- in proportion to what the investors put in and to what was recovered.

Meanwhile, the second anniversary of Madoff's arrest, which occurred on Dec. 11, 2008, is fast approaching. He's been incarcerated in federal prison since March, 2009, when he pleaded guilty to orchestrating the most massive Ponzi scheme in history while masquerading as a brilliant investor. He was sentenced to 150 years.

While Madoff languishes in prison, Leveton is organizing with other feeder fund investors to try to get Congress to change SIPC requirements. He wants the protection to be extended to the so-called "third parties" who unknowingly invested in Madoff and other Ponzi schemes.

"It seems to us that the group that actually sought out Madoff knew who he was," said Leveton. "It's the innocent victims that really deserve some protection here." ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |