Search News

Click chart to view other bond yields.

Click chart to view other bond yields.

NEW YORK (CNNMoney.com) -- Treasury prices slipped Thursday, as demand for government debt waned following a trio of better-than-expected economic reports on jobs, manufacturing and the housing market.

The Labor Department said the number of Americans filing for initial jobless claims last week fell below 400,000, to the lowest level since July 2008. While the job market is still not out of the woods, the drop was an encouraging sign.

Jobs data were followed by a report showing manufacturing activity picked up more than expected in December in the Midwest region, and pending home sales rose more than expected in November.

"The strong economic data is the main driver for Treasuries today," said Bill Larkin, portfolio manager at Cabot Money Management. Signs of an improving economy boosts confidence among investors, who then often flee safe-haven Treasuries in favor of riskier investments.

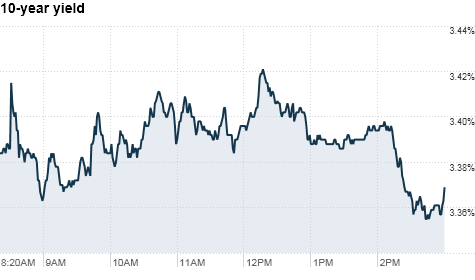

The price on the benchmark 10-year note fell Thursday, pushing the yield up to 3.37% from 3.34% late Wednesday. Bond prices and yields move in opposite directions. Yields for the 30-year bond rose to 4.43%, the 2-year note ticked up to 0.65%, and the 5-year note edged up to 2.07%.

Looking ahead: Larkin expects trading volumes to remain muted amid the year-end holiday period. But as traders return to their desks next week to start the new year, he said bond yields are likely to continue rising at a steady pace as the economy continues to recover. He forecasts the 10-year yield to rise to about 4% over the next year.

That's particularly problematic for the Federal Reserve, since the central bank is making an effort to move interest rates lower by injecting $600 billion into the economy through the purchase of long-term Treasuries.

"There's been a lot of criticisms of the Fed's recent policies, and a lot of people are concerned about how they're going to transition to neutral and even tighter monetary policy," Larkin said. "The market knows there's a lot of stimulus coming in for the first half of 2011, but they're looking beyond that." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |