NEW YORK (CNNMoney) -- Only in the fickle world of technology can a company with a market value of $200 billion and nearly 20% sales growth be considered yesterday's news.

But with Wall Street, Silicon Valley and the media currently in a full-blown "all Facebook, all the time" mode, the latest fashion is to declare that Google (GOOG, Fortune 500) is no longer relevant.

Piper Jaffray analyst Gene Munster made waves earlier this week when he said in a Bloomberg TV interview that Google has "given up" on social media and that for job seekers in tech, Facebook is what Google was five years ago. Google is now more like Microsoft (MSFT, Fortune 500), in his view.

Between the hit movie "The Social Network," the near canonization of founder Mark Zuckerberg in the press and that little Goldman Sachs (GS, Fortune 500) investment valuing the company at $50 billion, it's easy to understand why Google is an afterthought to some.

But to underestimate Google would be a colossal mistake. And interestingly enough, it looks like investors aren't completely buying into all the "Facebook is the new Google" hype.

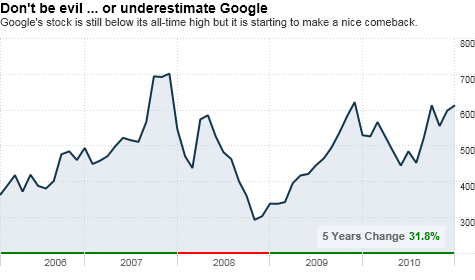

Google's stock has enjoyed a happy 2011 so far, gaining about 4% this week. Shares are now less than 2% below their 52-week high.

The company wowed attendees at this week's CES in Las Vegas with a preview of its newest tablet-friendly Android mobile operating system, dubbed Honeycomb.

The success of Android -- which is being used in phones and tablets made by the likes of Motorola Mobility (MMI), Dell (DELL, Fortune 500), Samsung and HTC, to name a few -- is a key reason why Google may continue to be a great growth company (and stock) for years to come.

The days of Google being almost exclusively wedded to keyword search are gone. That's why some think the worries about Facebook supplanting Google are overblown.

"Google's penetration is so broad, as is their flexibility. Who would have thought five years ago that Android would be such a big business?" said Stephen Lieber, portfolio manager of the Alpine Dynamic Transformations Fund, which owns Google.

"Competition from Facebook is not an issue of profound concern to me," Lieber added.

What's more impressive about Google making such considerable inroads in mobile is that it has done so while competing against Apple, which remains the top dog in consumer tech by a mile -- even if it doesn't feel a need to show up at CES.

Scott Kessler, head of tech sector equity research for Standard & Poor's, said that if anything, Google has to be more concerned about Apple (AAPL, Fortune 500) than Facebook.

After all, Apple's stock keeps hitting new all-time highs and the company just passed the $300 billion market value mark. Google, despite its recent comeback, is still trading nearly 20% below its all-time peak price from October 2007.

Apple appears to be that rare beast that is not succumbing to the law of large numbers. Google, on the other hand, is undeniably slowing down.

Earnings are expected to increase 18% a year, on average, over the next few years. That's impressive, but a far cry from the annual growth rates of 33% during the past five years.

Still, Google's stock looks attractive at just 18 times 2011 earnings estimates.

And Kessler, who considers himself more of a Google skeptic, concedes that the stock is reasonably valued. He has a price target of $700 a share on Google, nearly 15% higher than current levels.

For all the Google trash talking, a vast majority of analysts still have a buy rating on Google, he pointed out.

"People are no longer outwardly bullish or as effusive about Google. It's not at the hypergrowth phase that it was a few years ago," he said. "But even though the commentary is negative, people are still recommending the stock."

And with good reason.

Google generated a net profit of nearly $6 billion in the first three quarters of 2010 on sales of $20.9 billion. That's a net margin of nearly 28.6%. Google also has a balance sheet that's as squeaky clean as Apple's: $33.4 billion in cash and marketable securities and no debt.

So Wall Street may be infatuated with Facebook -- but it's telling that analysts still "like" Google as an investment. It probably would be a bad idea for investors to "unfriend" Google as well.

Reader comment of the week ... and a New Jersey music tout! I wrote earlier this week about the break-up of Motorola. It sounds like one reader isn't too impressed by either of them.

"So, let me get this straight. We have Motorola Mobility, which will make Cell Phones and Cable Boxes, the latter of which are not mobile at all... And Motorola Solutions, which will make Mobile 2-way Radios for Government...," wrote Eric Hidle. "They should have called them Motorola Retail Products and Motorola Government Money Vacuum."

Also, a Buzz shout-out goes to Twitter follower Matt Holdredge. (Love your Stimpy icon, by the way) I challenged my followers today to identify the band behind this apropos of Google song title: Surprise, Honeycomb.

That would be The Wrens, a group of New Jersey rock gods who may be the best band you never heard of ... partly because they take their sweet time releasing albums. "Secaucus" was released in 1996 and "The Meadowlands" (notice a pattern?) dropped in 2003.

Come on guys! You're due for a new album! And might I suggest "Ho-Ho-Kus" as a title?

-- The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |