Search News

NEW YORK (CNNMoney) -- JDS Uniphase, a company that lost a then-record $56 billion in 2001, is now one of the hottest tech stocks of 2011. As '80s sitcom "star" Yakov Smirnoff would say, "What a country!"

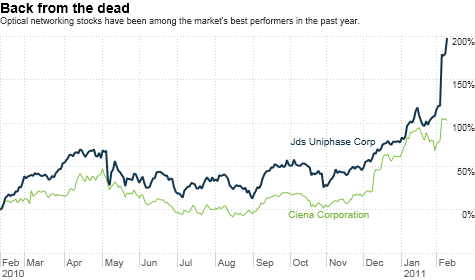

Yup, JDS Uniphase is back with a vengeance. The maker of optical networking equipment reported boffo earnings last week, and shares are up an astonishing 36% since then. So far this year, JDS Uniphase (JDSU) is up more than 65%, making it the top performing stock in the S&P 500.

In case you forgot, JDS Uniphase rode the tech boom of the late 1990s and was a favorite of momentum investors.

I wouldn't be surprised if some poor schlub tattooed the JDSU ticker symbol on his arm to profess his love for the stock. The Jim Cramer joke among traders back in the proverbial day was that JDSU stood for Just Don't Sell Us.

But the company's fortunes took a nasty turn following the bursting of the dot-com bubble. Demand dried up, resulting in the aforementioned massive loss. The stock continued to languish for years and fell to a low of just above $2 a share during those dark economic times of November 2008.

The fact that JDS Uniphase has made such a triumphant return from its nadir --the stock's now at about $24 -- is clear evidence that some investors are willing to once again embrace riskier, momentum plays.

And it's not the only tech stock to have made a stunning comeback as of late.

Fellow networking equipment company Ciena (CIEN) is up 30% this year. Shares trade at around $27, up from a February 2009 low of barely above $5. Another hot optical company, Finisar (FNSR), has surged from a low of just $2 a share in late 2008 to about $40 now.

Graphics chip maker Nvidia (NVDA), which was below $6.50 a share in late 2008, is now trading at about $24. The stock's up 56% this year alone.

And then there's satellite radio company Sirius XM (SIRI). It's trading for only about $1.76 a share. So unlike the others I've mentioned, it is still a penny stock.

But it's done its best Virginia Slims impersonation. It's come a long way, baby. Sirius XM is up from a low of 5 cents a share in early 2009, when many investors feared bankruptcy was imminent.

There's an obvious question that now begs to be asked. Is this all reasonable?

Yes and no.

Many of these stocks may have run up too far too fast and are due for a pullback. Investors rightfully should be worried about drinking the tech Kool-Aid again so soon after the last bubble.

But as trite as it may sound, this recent tech rally does seem a lot different than 10 years ago.

JDS Uniphase, for example, is a solidly profitable company that's growing rapidly. Analysts expect earnings for this fiscal year to more than double, while sales are forecast to rise 32%.

It makes sense. Thanks to the popularity of smartphones and data-hogging social networking and video sites, there should be more demand for networking equipment as well as companies catering to the so-called "cloud" trend.

"The entire networking sector had been in purgatory for close to a decade. But the Internet has evolved," said Sunil Reddy, a portfolio manager focusing on tech stocks for Apex Capital Management in Dayton, Ohio. "E-commerce has exploded. There's so much more video and data. This growth is going to go on for a while."

More importantly though, shares of JDS Uniphase are no longer valued at an absurdly high, bubbilicous price. The stock is trading at 26 times fiscal 2011 earnings estimates. Not cheap, but reasonable for a growth stock.

The same can be said for Finisar and Nvidia, which both trade at about 24 times earnings estimates for their current fiscal years.

"Valuations got so overstretched back in 2000 that it was obviously troublesome. Many companies were trading over 100 times earnings estimates," said Doug MacKay, CEO of Broadleaf Partners, an investment firm in Hudson, Ohio.

MacKay, who worked as a tech fund manager for Oak Associates during the glory days for tech in the late 1990s, said he's learned the hard way that companies with super-high valuations are unlikely to sustain them for long.

He's been keeping an eye on JDS Uniphase and Ciena, two stocks he owned at Oak, but has not pulled the trigger on them for his current firm. But MacKay said tech is still one of his favorite sectors.

"If you want to invest in growth, tech is still an area where you have to play," MacKay said.

He just prefers to stick with tech stocks at more attractive prices. He owns Qualcomm (QCOM, Fortune 500), Google (GOOG, Fortune 500) and Apple (AAPL, Fortune 500), all of which trade at price-to-earnings ratios in the mid-to-high teens.

Reddy, whose firm owns shares of Finisar, agreed that investors have to keep an eye on valuations. He said his biggest worry is that some stocks may be ahead of themselves.

Just don't call it another bubble right now.

"Like with any cyclical sector, people get too enamored with companies and when that happens, it's a cause for concern. But I don't think we're there yet," he said.

-- The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |