Search News

NEW YORK (CNNMoney) -- About this time a year ago, few people on Wall Street knew who Fabrice Tourre was. That was all about to change very quickly.

April 16, 2010: Goldman Sachs (GS, Fortune 500) is accused by the Securities and Exchange Commission of defrauding investors in a complex pool of mortgage securities known as Abacus. At the center of the charges was a trader who described himself as the "fabulous" Fab.

|

| Hey? Remember me? Goldman Sachs trader Fabrice Tourre testifies in front of Congress in April 2010. |

Tourre and others at Goldman were later dragged in front of Congress to explain themselves. How could we forget the marathon hearing that tested TV censors everywhere thanks to the repeated reading of an e-mail with a naughty, scatological reference by Sen. Carl Levin.

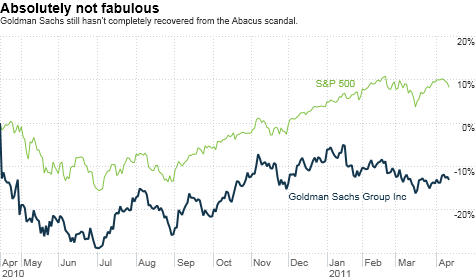

Flash forward to today. Goldman has recovered from the worst of this scandal, but it's still wounded. The stock, which tumbled last spring and early summer before settling with the SEC for $550 million in July, is up 25% from its lows.

But shares are still about 12% below where they traded before the SEC allegations came to light. Other big banks are still lower than this time last year. However, the broader market has enjoyed a nice rally. The S&P 500 is up nearly 10%.

So where does Goldman go from here? The company arguably stands to benefit even more from the recent uptick in merger activity, initial public offerings and corporate debt sales than just about any other firm on Wall Street.

Is that already reflected in the stock price though? Goldman Sachs currently trades at 12 times 2011 earnings estimates. That may sound inexpensive. But rivals Morgan Stanley (MS, Fortune 500), JPMorgan Chase (JPM, Fortune 500), Bank of America (BAC, Fortune 500) and Citigroup (C, Fortune 500) are all trading closer to 10 times this year's profit forecasts.

Goldman also trades at a premium to its competitors on a price-to-book value ratio basis as well. Book value, which measures how much a company is worth after you subtract its liabilities from its assets, is a common yardstick to compare financial stocks.

Goldman's price-to-book ratio is about 1.3. JPMorgan is trading around 1.1 times book while Morgan Stanley, BofA and Citi are each trading below book value.

Of course, Goldman has always enjoyed a premium valuation to its peers because of its reputation and leadership role among the blue blood investment banks. But does Goldman still deserve it?

Goldman may have settled with the SEC, but it looks as though investors still don't completely trust the company. And Goldman continues to make headlines for all the wrong reasons.

Just today for example, there are some wondering if a negative call on commodity prices from Goldman -- which up until now had been among the bigger commodity bulls on Wall Street -- is turning out to be a self-fulfilling (and self-serving) prophecy.

Crude oil prices plummeted Tuesday, along with the price of gold, silver, corn, wheat and many other hot commodities.

There was also news Tuesday of a lawsuit filed against Goldman by the co-founders of chip company Marvell Technology (MRVL). Executives from Marvell claim that they were forced to sell shares of their company in 2008 due to what they allege was a fraudulent margin call.

It is obviously up to the legal system to decide who is right in this dispute. But the mere fact that Goldman is still being accused of shady practices just shows how risky it is to make bets on big Wall Street firms that, fairly or not, are often presumed guilty by the market.

"Goldman Sachs is likely dead money," said Harry Rady, president and CEO of Rady Asset Management in San Diego. "The bad press isn't reflective of the underlying fundamentals at the company. But the headlines are weighing on the stock."

Rady said he sold his firm's stake in Goldman for those reasons a few months ago. He also dumped Morgan Stanley, arguing that increased capital requirements will create a drag on both firms.

Bob Bacarella, manager of the Monetta Fund (MONTX) in Wheaton, Ill, said he also sold his stake in Goldman. He did so at the end of last year. I actually spoke to Bacarella shortly after the Abacus scandal last April, and at that time he was still bullish on Goldman. So what's changed?

He said it's now clear that the fraud charges against Goldman and concerns about how tougher financial regulation (much of which was crafted in the wake of Abacus) will impact the firm, will be an overhang on the stock for a while.

"I still like Goldman Sachs for the long-term," he said. "But it's out of favor. It's not something I'd chase right now."

-- The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |