Search News

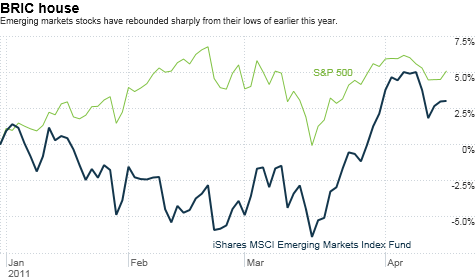

NEW YORK (CNNMoney) -- The economies of the so-called BRIC nations -- Brazil, Russia, China and India -- are still growing like wild. But for investors, emerging markets had taken a backseat to the United States for much of this year.

That is rapidly changing, however.

One of the most widely watched barometers of the BRIC countries, the iShares MSCI Emerging Markets Index Fund (EEM), has been on fire lately. While this exchange traded fund is still lagging the performance of the S&P 500 (SPX) year-to-date, the ETF has surged 10% in the past month.

And according to research firm EPFR Global, more money flowed into emerging market stock mutual funds last week than equity funds for developed markets for the first time this year. Investors favored emerging market bond funds over developed bond market funds as well.

This trend may continue even though China's economy has cooled slightly in the first quarter and inflation is now a major headache for most emerging markets.

Simply put, investors appear to have rediscovered the sexier growth prospects around the rest of the globe.

The U.S. economy still has problems in the housing and job markets. Europe still has a sovereign debt crisis. And Japan's economy was stagnant even before the tragic earthquake and tsunami hit last month.

The strong demand for the initial public offering Thursday of Arcos Dorados, a Buenos Aires-based franchisee of McDonald's (MCD, Fortune 500), is clearly an indication of the excitement about South America as a market. Shares of Arcos Dorados (ARCO) surged 25% in their first day on the New York Stock Exchange.

But just like with any market, investors need to tread cautiously. Remember, it wasn't that long ago that emerging markets stocks were getting hit hard by the political turmoil in the Middle East and North Africa. That region is obviously still volatile.

However, it does seem encouraging that investors may no longer be treating "emerging markets" as this amorphous, monolithic blob. The upheaval in Libya and Egypt shouldn't be an excuse to sell a stock headquartered in Russia, Brazil or South Korea.

The key to any smart investing strategy involving developing markets is to own a diverse group of companies in several countries, said Deborah Vélez Medenica, manager of the Alger Emerging Markets Fund (AAEMX) in New York. Don't make a bet on just China or just India for example.

Along those lines, Medenica said some of her favorite holdings are Brazilian bank Itau Unibanco (ITUB), Russian steel and mining firm Mechel (MTL) and Chinese cement company Anhui Conch.

Oliver Pursche, co-manager of the GMG Defensive Beta Fund (MPDAX) in Suffern, N.Y., agreed that a wider approach to emerging markets makes more sense than trying to find a handful of hot companies.

"If you don't have your boots on the ground in a market, you really should look at a broader basket of stocks and focus on a bunch of sectors." he said.

Pursche said his fund is capitalizing on healthy growth overseas through the WisdomTree Emerging Markets SmallCap Dividend (DGS) ETF. That fund, as its name implies, owns smaller global companies that pay dividends. So there's that added kick from dividend payments to go along with earnings growth.

Another positive for emerging markets is that the stocks are much cheaper now than they were a few years ago.

According to research from Alex Bellefleur, financial economist with Brockhouse Cooper in Montreal, emerging markets stocks are now trading at around 15 times trend earnings, a ratio that adjusts for long-term growth.

To put that in perspective, emerging markets stocks traded at about 25 times trend earnings before the global financial crisis in 2008.

Medenica said she thinks investors have already factored in slower growth -- especially in China -- and that's why the stocks are now relative bargains.

"Everybody is well aware that growth is slowing down in China," she said. "Nobody believes the current growth rates are sustainable."

Still, it can't be stressed enough just how volatile emerging markets can be. Inflation concerns can't be totally dismissed either.

Indian tech giant Infosys (INFY) plunged nearly 15% Friday after the outsourcing firm warned that its profits would be weaker than expected as higher labor costs start to eat into earnings.

So for investors who are a little wary of investing directly in companies headquartered abroad, it still makes sense to buy leading U.S. firms that have a large presence in hot, developing markets.

Pursche said some of his top picks are fast food chain Yum Brands (YUM, Fortune 500), PepsiCo (PEP, Fortune 500) and iron ore minder Cliffs Natural Resources (CLF).

Reader comment of the week. I've been discussing the sad stock performances of smartphone and tablet also-rans Research in Motion and Motorola Mobility all week over on Twitter. On Friday, I asked readers to come up with a name to call a hypothetical merger between RIMM and MMI.

My favorite came from Jeremy Blaine, aka @BlaineJP. "4M, they'd be ahead of 3M in the phone book and everything!"

Ha! Alphabetical order might be the only area where those companies would lead though.

-- The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |