Search News

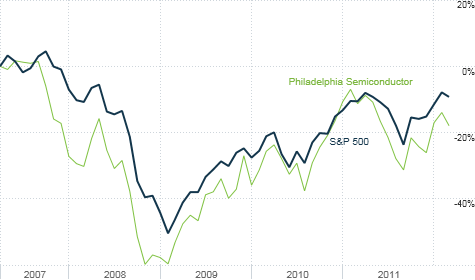

Follow the chips? The broader market has closely mirrored the performance of semiconductor stocks for the past five years. So the recent sell-off in the SOX may be a bad sign.

NEW YORK (CNNMoney) -- Spring training is finally here and baseball fans are wondering how the Sox will do this year.

Both the Boston Red and Chicago White have new managers: ex-Mets skipper Bobby Valentine in Beantown and former Nolan Ryan punching bag Robin Ventura in the Windy City.

But for investors, the Sox they care most about call The City of Brotherly Love home. Yes, the Philadelphia Semiconductor Index, or SOX (SOX), is getting a lot of attention lately -- and not in a good way.

Chip stocks have been pummeled over the past week. The SOX was down 1.2% Tuesday and has now fallen more than 6% in the past five trading days.

This could be bad news for the broader market, at least in the short-term. That's because there is a very tight relationship between the performance of chip leaders like Intel (INTC, Fortune 500), Texas Instruments (TXN, Fortune 500) and Nvidia (NVDA) -- to name three of the largest of the 30 companies in the SOX -- and the S&P 500 over the past few years.

The so-called correlation between the SOX and S&P 500 since 2005 has been 84%, according to data from Asbury Research, an independent research firm in Chicago. Basically, that means that 84% of the time, the SOX and S&P 500 have moved in the same direction.

Asbury's John Kosar said the correlation between the S&P 500 and SOX so far in 2012 is above 90%.

Chip stocks are often considered good leading indicators for the market and economy. If big tech firms like Apple (AAPL, Fortune 500), Microsoft (MSFT, Fortune 500) and IBM (IBM, Fortune 500) are going to produce more computers, servers, smartphones, gaming consoles and other gadgets, one of the first steps is to order the semiconductors that power all these devices.

So chip stocks may be that proverbial canary in the coal mine. If they start to lose momentum, all of tech and even the entire market may do so as well.

The semis are a microcosm of what's been happening with most stocks this year. Even after the recent sell-off, the SOX is still up more than 10% year-to-date.

That's a big move in a short period of time. Many strategists feel a correction in stocks is overdue following the big moves up in January and February.

"Nothing goes up forever. We had been expecting this for a couple of weeks," Kosar said. "It's just statistics. As fearless as investors have been lately, the fastest horses should crack first."

Now, this may just be a case of hot stocks cooling off as opposed to a truly bearish, longer-term sign for the economy and stocks.

After all, hopes are high that Apple will have another hit on its hands with the next iPad -- and that should help chip companies tied to Apple like ARM Holdings (ARMH) and, if you believe the iPad 3 4G rumors, Qualcomm (QCOM, Fortune 500).

What's more, PC makers Dell (DELL, Fortune 500) and HP (HPQ, Fortune 500) may get a break later this year. They're moving past the supply disruptions that plagued the disk drive business in the wake of Thailand's flooding last year, which shut down factories.

"When you look at the bigger picture for chip stocks, there is not a lot of evidence that demand is deteriorating," said Cody Acree, a semiconductor analyst at Williams Financial Group in Dallas.

Acree did say that the recent signs of China's economy slowing down a bit more than expected could be worrisome for chip stocks. But it's not as if China's economy is crashing. Going from a 8% growth target to 7.5% only counts as a hard landing if you're a myopic trader prone to hyperbole.

So investors should keep an eye on the chip stocks. It's not an encouraging sign if they keep falling. But it will be far more important to see what the semi companies say about demand when they start reporting first-quarter results next month.

If the guidance matches the currently gloomy stock performance, then the market may have a really big problem.

Best of StockTwits: The markets are taking a bit of a breather. This should serve as a cautionary reminder to traders who think Newton's famous saying doesn't apply to stocks. Meanwhile, Amazon (AMZN, Fortune 500) defied market gravity today and was up nearly 1%.

howardlindzon: Today we are finally seeing the other side of 'Momentum' ....why you dont' chase and how quickly hard earned profits disappear.

bespokeinvest: VIX up 15%, biggest one-day gain since 11/9/11. #fear

I've been saying all this year that investors still need to be worried (maybe even afraid) about macro concerns such as Greece and China.

A little fear is healthy. The spike in the VIX (VIX) shows that just because stocks surged in January and February may not mean we are in a new bull market. It may just mean that volatility (for both big moves up and down) is still alive and well.

justmegregory:$AMZN big tech anomaly of the day... incredible

ivanhoff: Today's action in$AMZN must frustrate long-time bears big time. Huge down day for the market and $AMZN is green

Amazon is a tough stock to figure out. It's arguably overvalued but the fundamentals are fantastic. And you have to applaud management for taking a long-term approach. It is willing to sacrifice profit margins in the short run for bold strategic moves like free shipping and a "cheap" tablet with the Kindle Fire.

Jeff Bezos has proven the doubters wrong too many times to count. That makes Amazon a dangerous stock to short.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()