Search News

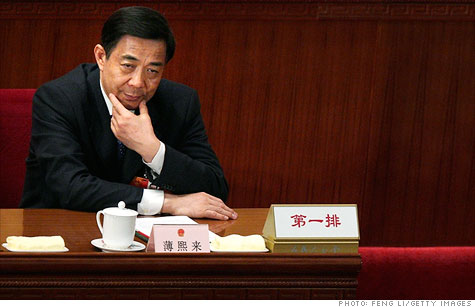

Bo Xilai resigned his party post in March under a cloud of corruption.

FORTUNE -- On a recent Saturday evening, as the extraordinary fall of the powerful Chinese politician Bo Xilai was still unfolding, a group of friends gathered outside Beijing for dinner at an elegant villa owned by a wealthy, well-connected young couple. Around the table sat some of China's most prominent private business people: a tech titan and his wife; a couple of private equity guys with friends in high places among China's economic policymakers; a big-time lawyer. All have been beneficiaries of China's astonishing transformation over the past 30 years, and all, more to the point, are now in a position to help drive even more change over the next 20 years.

For three hours the group talked of nothing but the operatic rise and fall of Bo Xilai, the former party secretary in the mega-city of Chongqing, and a "princeling" -- the son of a founding member of the Chinese Communist Party. There was gossip aplenty about the lurid details -- what, exactly, was the nature of Bo's wife's relationship with the murdered British businessman whom she might have plotted to kill? How much money had the family spirited out of China into banks abroad? Yet the overarching theme of the evening was, simply, an expression of relief. China, one of the guests said, may have just come through its biggest political crisis since the Tiananmen massacre in 1989, "though this one," she added, "was much subtler."

So subtle that a thick haze of misapprehension surrounds the exact nature of the "crisis" and how it relates not only to China's political future, but to its economic one as well. Consider that in May, CLSA Asia Pacific Markets released a research report asserting that Bo's dismissal was "unlikely to have concrete impact on the country's economic or political policies." Yet according to high-ranking businessmen and government officials in Beijing, Bo's failure to ascend to the all-powerful standing committee of the Communist Party's politburo -- as China's once-in-a-decade transition of leadership proceeds without him -- unquestionably will impact economic policy.

10 most powerful businesspeople in China

In fact, his demise is a hopeful sign that of the broad factions currently vying for power in Beijing, China's economic reformers, led by Li Keqiang, likely to be the next Prime Minister, and Wang Yang, the party chief in affluent Guangdong province, are now gaining influence. Whether the man likely to be China's next President, Xi Jinping, is also inclined toward reform remains a critical question. But for now, Bo's "new left populists," who cared little about moving China toward the rule of law and much more about redistributing wealth (sometimes to their own benefit), are in retreat, to the delight of the entrepreneurial class across the country.

Anyone who has followed Bo Xilai's career understands that he exerted power, as the lawyers say, extra-constitutionally. The Communist Party in China does that routinely, of course, but there are large differences in degree among party leaders. The reformers, for example, want to push China toward something resembling a rule of law. Anyone who thinks Bo Xilai agreed with them need only talk to a man named Yang Rong, who was the largest private shareholder of Brilliance Automotive, once one of China's biggest carmakers. In 2002, when Bo was governor of Liaoning, his government seized Yang's stake in the company, then worth $700 million, saying the assets belonged to the state. Yang sought to sue the government, but the case magically "disappeared," says a lawyer involved. Not long after, Yang Rong fled to the U.S.

That history would not surprise many of the private business people in Chongqing, the city of 30 million that Bo ran. During his regime he used any number of private businesses as the government's piggy bank. Under the guise of an anticorruption campaign -- broadly popular among the public -- Bo went after an array of his enemies, rich businesspeople that he could smear as being part of organized crime rings. "The law had nothing to do with it," says Tong Zhiwei, a law professor at Shanghai's East China University of Political Science and Law, who did a lengthy study of Bo's tenure in Chongqing. "He went after whoever he wanted."

Prior to Bo's demise there were three broad factions struggling for power in the next government. Bo's populist faction was uninterested in extending the rule of law and more interested in what Brookings Institute scholar Cheng Li calls an "ultra-egalitarian" economic policy aimed at redistributing wealth and increasing the state's role in the economy. Another camp is the "statists" -- those who believe in the status quo, with the government tightly controlling the commanding heights of China's economy. The third group is the economic reformers, who laid down their marker in February with the public release of a World Bank report called "China 2030" -- a blueprint for the type of economic reforms the country urgently needs.

Earlier this year Bo was in discussions with the "statists" over the contours of the next government. The economic reformers were "going to be the ones left out," says one source privy to the negotiations. Now, the economic reform wing is ascendant, and engaged with the statists in a struggle for control of every key economic ministry, according to one foreign CEO who had high-level meetings with the Chinese government in mid-May.

How that struggle will play out is unclear, but the stakes couldn't be higher. As the recent economic data out of China suggest, the era of unbridled growth may be over. Industrial production and exports are down sharply. China's challenge is to reinvigorate the small- and midsize-business sectors, "for whom contracts and a more stable legal regime are critical," says Yasheng Huang, an MIT political scientist. Beijing also wants a higher-tech economy, one in which intellectual-property protection is all the more important. Beijing, in other words, needs to get on with it -- the sooner the better. With Bo Xilai out of the way, there's more reason to think that might happen.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |