Still wondering what corporate boards are good for

UCLA law professor and one-man-media-empire-in-the-making Stephen Bainbridge has responded to my response to his critique of my very first post on this blog, "Who needs a board of directors, anyway?" (Dizzy yet?)

Bainbridge's essay is highly erudite, with footnotes and everything. Reading it will, to quote an ill-fated Fortune ad campaign of a few years back, "make your brain bigger." But no way am I giving Professor B the last word. His main point is that corporate boards are useful because groups make better decisions than individuals. He concludes: Team production is imperfect, whether the product is a manufactured good or a corporate decision. Teams are subject to unique cognitive biases, such as groupthink, and unique sources of agency costs, such as social loafing. With respect to the exercise of critical evaluative judgment, however, groups have clear advantages over autonomous individuals. Not only do groups clearly outperform average individuals in a given sample, there is considerable evidence that the process of group interaction has synergistic effects allowing groups to outperform even the best decision makers in the sample. Now surely corporate boards serve some purpose, or we wouldn't have them. But is it really because small groups are so great at making decisions? In his fascinating new book Infotopia: How Many Minds Produce Knowledge, University of Chicago law professor Cass Sunstein offers ample evidence of the flaws of what he calls "deliberating groups." Such bodies do well on questions where there is a clear correct answer. But on less definitive matters--like most of the questions that corporate boards have to deal with--group deliberation often has less to do with finding the right answer than with imposing the views of the most outspoken (or powerful) members of the group. Consider the experiment that Sunstein and two other scholars conducted recently in Colorado. They gathered residents of conservative Colorado Springs and liberal Boulder in small groups, segregated by city, to discuss global warming, same-sex civil unions, and affirmative action. Participants were asked to state their opinions anonymously before and after the discussions. Recounts Sunstein: In almost every group, members ended up with more extreme positions after they spoke with one another. ... Aside from increasing extremism, the experiment had an independent effect: It made both liberal groups and conservative groups significantly more homogeneous--and thus squelched diversity. This sort of groupthink is potentially disastrous for a corporate board, which is there in part to keep the CEO from driving a company over a cliff. To be effective, boards need to foster diversity and dissent. The practice of meeting regularly without the CEO in the room, which has become standard since the scandals of 2001 and 2002, is a big step in this direction. But too much diversity and dissent can be a problem, too, as HP's recent board troubles indicate. It's a delicate balance, and my bet is that most boards fail to achieve it. That's not to say that the two other possible methods of governing corporations in a free economy--shareholder democracy and self-perpetuating autocracy--are any easier to get right. Just that we shouldn't expect too much of the setup we've got, and shouldn't be afraid to tweak it in ways that might improve it. So the stock market is irrational. So what?

Michael Kinsley has a new piece in Slate this week purportedly offering "proof that the stock market is irrational." As the someday-to-be-author of a book tentatively titled The Myth of the Rational Investor (due out early next year, if I get cracking on the rewrite), I ought to agree with him. But I just can't bring myself to. Maybe it's because he unfairly disses my buddy Milton Friedman. Or maybe it's because, after dumping on the stock market for 900 words, he offers no plausible alternative.

Kinsley bases his argument on the current boom in private equity, and the fact that the private equity guys are almost always able to resell the companies they buy for more than they paid for them. The details are different, but the principle is the same. Private investors buy a company from its public stockholders. They have a letter from an investment bank saying the price is a fair one. They usually have the support of management, or they actually are the management. The public stockholders have little choice. But time and again--surprise, surprise--the investment bank turns out to be wrong. The company is actually far more valuable! (And any bank that can't be counted on to get this wrong will not be in this profitable line of work for long.) Soon, the company is sold at a large profit, either to another company or back to the public. So far, so indisputably true. And Kinsley is right to say that this state of affairs casts some doubt on the efficient market hypothesis, the theory that the stock market always accurately reflects all available information about the companies traded on it. If the market is efficient, he asks, how can the same company sell at three different prices depending on who happens to be doing the buying and selling? Actually, you can make an efficient-markets argument to explain the price discrepancy, as scholar Michael Jensen has been doing for the past quarter century: Private-equity-owned companies (a.k.a. leveraged buyouts) avoid a lot of the conflicts between owners and managers that plague publicly traded companies. The owners (the private equity guys) are clearly in charge, and therefore their companies are run better, and worth more. Kinsley allows that this might be true, but then argues: [I]f these deals aren't a swindle, then the stock market itself is a swindle. It does not maximize value for its working- and middle-class investors. The stock market leaves money on the table waiting for "private equity" to swoop down and pick it up. Furthermore, Milton Friedman was wrong, and the other famous economist who died this year, John Kenneth Galbraith, was right: The free market in corporate shares doesn't produce well-run companies. I wasn't aware that Friedman had ever claimed that it did. He was not a believer in the efficient market hypothesis, at least not in the extreme version of it that held sway at the University of Chicago Graduate School of Business (and a lot of other business schools) in the 1970s and 1980s. As he put it to me a couple of years ago: We all know the market is not efficient in a descriptive sense. But that doesn't mean that the efficient market is not the best approximation if you don't have anything else to use. And that's really the key. In our current system of stock-market-driven capitalism, corporate insiders make out like bandits, investment banks skim millions for themselves, and private equity firms profit repeatedly off the mispricing or mismanagement of public companies. Yet, somehow or other, stock market investors have made more than 10% a year since 1926. That doesn't necessarily mean they will in the future--but I also wouldn't be surprised if a lot of the private equity deals being closed these days go sour, too. There's just too much money flowing into the sector for all of it to be invested wisely. Over time, though, private equity will continue to serve as a useful alternative to the inevitably conflicted management model of the publicly traded company. And without the public equity markets, the private equity guys would never be able to cash in. It's a symbiotic relationship. Is it also a messy, wasteful way of doing things? You bet. Got a better alternative? Galbraith never did, which is why he will go down in history as a brilliant critic with few constructive economic ideas of his own (Thorstein Veblen with much better table manners) while Friedman's legacy lives on in policies and institutions that affect our lives every day. As for Kinsley, he's still the cleverest political pundit of the past couple of decades (in print, not so much on Crossfire). But he had a seriously wrongheaded piece about stock option accounting in Slate a few years ago, and now this. Maybe it's time for him to take his business commentary private. (This should, of course, dramatically increase its value, enabling him to charge much more per column when he takes his opinions public again in a couple of years.) Why hits still matter (and will continue to do so)

Mrs. Curious Capitalist and I went to a performance Tuesday night by the Greatest Pop Singer of Our Age, Brazil's Marisa Monte. It was swell and all, but it was also deeply weird--for the simple reason that I had no idea which songs were her hits.

I think we own every CD by Ms. Monte, a mostly enchanting 39-year-old amalgam of pop diva, avant garde experimentalist, and Alan Lomax. But I've never heard one of her songs on the radio, never had her music recommended to me on iTunes, never known anybody else who was a fan. I simply heard a snippet of her singing on a Banana Republic ad in the late 1990s (yes, I know this is a lame way to discover music; it's a pattern with me), read an article about Brazilian music in the New York Times Magazine that identified her, and started buying up her work on Amazon.com. Since then we've been listening pretty regularly but without any sort of context (or Portuguese language training). A few songs with clearly enunciated choruses (like "Passe em Casa," from Monte's Os Tribalistas collaboration with Arnaldo Antunes and Carlinhos Brown) or English bits ("Amor I Love You," from Memorias, Cronicas e Declaracoes de Amor) have stuck in my head, but mostly it all just runs (very pleasantly) together. So at the concert Tuesday night it was invariably a surprise to hear which songs the mostly Brazilian crowd sang loudly along with (those were the hits) and which they did not. If only I'd known beforehand, I could have sung along too! (Well, maybe not.) Because I've spent a lot of time lately talking to marketing professors about how consumers make choices, this got me thinking. Way out on the long tail of utopian opinion about the impact of the Internet is the viewpoint that each of us possesses entirely unique tastes that will for the first time be truly satisfied once those nasty Old Media companies and their marketing campaigns and distribution chokeholds get out of the way. I'm not sure anyone actually holds this extreme opinion (Mr. Long Tail himself, Chris Anderson, certainly doesn't), but I do think a lot of Web 2.0 types at least tend in that direction. They're partly right: Individual tastes aren't nearly as homogeneous as the media output of the network-TV, top-40 radio, monopoly-newspaper era. But they are not of infinite variety, and are not arrived at independently. As French scientist Henri Poincare wrote almost a century ago, When men are brought together, they no longer decide by chance and independently of each other, but react upon one another. Many causes come into action, they trouble the men and draw them this way and that, but there is one thing they cannot destroy, the habits they have of Panurge's sheep. Panurge was a character from Rabelais's Gargantua and Pantagruel who caused a flock of sheep to jump off a ship by throwing the lead ram overboard. But I'm thinking of a more positive element of crowd psychology: If I had only known what other people liked (or which tracks Brazilian radio stations played a lot), I would have enjoyed the Marisa Monte concert even more. Abundant and easily accessible content, and increasingly sophisticated means of steering us toward things we'll probably like (Jeffrey O'Brien has a great article about this in the current Fortune), are changing a lot about how the media world works. (For example, in the pre-Amazon.com era I probably never would have gone to the effort to acquire Marisa Monte's CDs.) But we humans will still want shared experiences--a.k.a. hits--and there will always be money to be made in manufacturing, distributing, and marketing them. Who's going to make that money? Now that's another question entirely. Milton Friedman: Usually right, and usually victorious

My last conversation with Milton Friedman--who died today at the age of 94--was in October 2005. I was working on an article about monetary policy after the impending retirement of Alan Greenspan and I figured it couldn't hurt to consult the most important monetary economist of the past half century. (The most important monetary economist of the whole century was Friedman's idol, Irving Fisher--but Fisher didn't have nearly as much success as Friedman in winning central bankers over to his ideas.)

Getting Friedman (I'm sorely tempted to refer to him as Uncle Miltie, but that doesn't seem appropriately respectful) on the phone wasn't a difficult endeavor; he was about the most accessible major public figure on the planet. I'd usually e-mail to ask him when and where I should call (until recently, when he and his wife Rose moved full-time to their apartment in San Francisco, he split his time between there and a house on the coast in Sea Ranch). My colleague Shawn Tully preferred to call and leave a message--Friedman invariably called him back collect. Friedman came through for me on that interview 13 months ago. He reeled off a list of other countries that had experienced high economic growth and low inflation during the Greenspan era. Then he said, Have all these countries found a genius like Greenspan? What the foreign experience suggests is, you don't need a genius. You just need someone willing to make fighting inflation his top priority. That's how Friedman talked. No gobbledy gook, no hemming and hawing. Just a clear voice (he didn't sound a day over 60) speaking in tones of remarkable certainty. That certainty was maddening to some, especially when Friedman seemed to be wrong--and he certainly could be that. He wanted central bankers, for example, to do nothing but target the growth of the money supply. This was impractical, as current Fed Chairman Ben Bernanke said in a speech last week, because the money supply can't be reliably measured. But Friedman's big-picture message that keeping prices steady is the only thing a central bank can do and do well was both correct and, happily, persuasive. And so it went with most of his big ideas. Sure, he often got the details wrong. But on the major issues Friedman was not only usually right but also had the tide of history with him. Friedman was, most importantly, one of the great intellectual champions of the return to unfettered markets that began in the late 1970s. His 1962 book Capitalism and Freedom helped begin the discussion; his and Rose's 1980 PBS show Free to Choose helped push his side to victory. The products of Friedman's libertarian worldview were more varied than this thumbnail account might lead you to believe, though. He was an influential voice in calling for the end of the military draft. He was the first to broach the idea of school vouchers in polite conversation. His idea of a "negative income tax" for the poor is now partially embodied in the form of the Earned Income Tax Credit. Then there was his famous statement, in a 1970 New York Times Magazine article, that the job of a CEO is to run things in accordance with the desires of a company's owners, "which generally will be to make as much money as possible while conforming to the basic rules of the society." This profits-first argument was a bombshell at the time, and acceptance of it has waxed and waned since. But it is telling that nowadays even outspoken advocates of "corporate responsibility" usually make the case that what they're really trying to do is maximize long-run shareholder value. Chalk up another victory for Uncle Miltie. Which options sins are committed most?

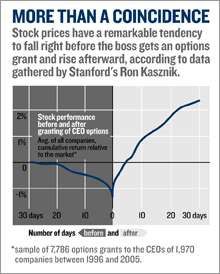

An expanded version of my post a couple weeks back about "spring-loading" and "bullet-dodging"--options practices that are less obviously illegal than backdating but still smell a little bit like insider trading--is now available in the pages of the Nov. 27 Fortune and online. One question that I didn't address in the article, mainly because I could find no clear answer to it, is exactly how widespread "spring-loading" and "bullet-dodging" really are. To quote from my article (all self-respecting bloggers must quote from their previous work): Bullet-dodging means "delaying options grants until just after the release of bad news (or moving up the release of bad news to precede an already scheduled grant)," while spring-loading means "timing an options grant to precede the announcement of good news (or delaying the happy announcement to follow an already scheduled grant)." Finance and accounting scholars began talking about this stuff way back in 1995, when NYU's David Yermack circulated a paper that showed the same pattern visible in the chart above: Stock prices tend to drop in the days before a CEO gets an options grant, and rise afterward. Yermack speculated that spring-loading and bullet-dodging were the causes. A couple years later, David Aboody of UCLA and Ron Kasznik of Stanford documented the same stock price patterns around regularly scheduled grants, which they interpreted to mean that executives who couldn't move their grants found ways to move the news instead. In 2004, though, the University of Iowa's Erik Lie suggested that some companies were setting their options grant dates after the fact, and lying about it in their financial statements and on their tax forms. A 2002 rule change brought on by the Sarbanes-Oxley Act, decreeing that options grants must be reported within two days, gave Lie additional research fodder. He found that companies that reported their grants late were far more likely to have the tell-tale v-shaped stock chart--thus convincing him that backdating explains most of the strange pattern in stock returns around options grants and that spring loading and bullet dodging "play a minor role." As Lie writes on his website: For example, if spring-loading and bullet dodging played a major role, we should observe pronounced price decreases before grants and increases after grants irrespective of whether they are filed on time, but we don't. Thus, it appears that either (a) spring loading and bullet dodging are not widespread or (b) these practices typically fail to lock in substantial gains for the option recipients. Lie says he has no idea which of these two explanations is closest to the truth. But Stanford's Kasznik has "a thought" on this, and I think I agree with him. Here's how he put it in an e-mail last week: Given that backdating is essentially an outright accounting (and tax) fraud--if not properly disclosed and accounted for--I doubt that so many companies and executives would engage in this kind of activity. The other mechanisms, i.e., spring-loading and bullet-dodging, perhaps do not have the same magnitude of impact as backdating but are "less risky" from the corporate and executive perspective. But, again, this is just a thought. Empirically, as Erik Lie also points out, it is hard to disentangle these effects for a large sample (unlike the SEC which has access to documents and other evidence not publicly available). No, the U.S. isn't losing the global talent war

The people at Der Spiegel, the German newsweekly, were nice enough to translate into English a pretty compelling article from last week's issue. Here's how it begins:

They are fed up, truly fed up. Fed up with the constant bickering over the costs of wage benefits, social reforms, elimination of subsidies, store closing hours and all the other symbols of a country stuck in bureaucratic and legislative gridlock. The "they" of the article are well-educated young Germans--doctors, architects, lawyers, etc.--who have decided that their futures lie elsewhere. The main statistic used in the article to back this up is that in 2005, for the first time in memory, more Germans left the country (144,815) than returned (128,052). I'm assuming the "returnees" include a lot of ethnic Germans emigrating from Eastern Europe, but I'm not entirely sure about that. The article says Germany still has an overall net inflow of 80,000 immigrants a year, but the people leaving are mostly well-educated and the ones coming in aren't. This is all bad news for Germany, although I imagine the country will somehow muddle through. Given how many millions of smart people Germany has lost over the past two centuries to immigration, war, and genocide, it's amazing that the remaining inhabitants can walk and chew gum at the same time, let alone design and build Mercedes SLR McLarens. My point in bringing this up, though, is to contrast Germany's situation with that of the U.S., the number two destination (after Switzerland) for emigrating Germans. Although other factors will surely come into play, I think the most important determinant of national or regional economic success over the coming decades will be the presence of talented people. And while there's been lots of worried talk over the past few years about the U.S. losing its edge in the global talent wars, much of it is overwrought. It's true that the great one-way highway of Indian and Chinese talent moving to the U.S. to escape a dysfunctional economy in India and a repressive state in China has now become a two-way street. That, as David Heenan writes in his book Flight Capital, poses some real challenges for the U.S. But we're still far better positioned than most countries to attract talented people from overseas and keep talented natives at home. Certainly better positioned than Germany. That's because (a) we speak English, the global language of the well-educated, (b) we have great universities, (c) we're more welcoming of outsiders than most European and Asian countries, (d) we have a dynamic, entrepreneurial economy that keeps spawning new companies and even industries, and (e) we have lots of livable, pleasant cities. If you were stuck in traffic getting to work this morning and you think (e) is a bunch of baloney, try commuting in Bangalore. UPDATE: One important matter I didn't bring up in my post--whether U.S. immigration policies discourage smart foreigners from coming here--is discussed in the comments below. It's pretty clear that U.S. immigration laws are not designed to strengthen our position in the global talent wars, unlike those of, say, Australia or Canada. That we keeping bringing in talent anyway is testament to something uniquely attractive about the U.S. As for Jens Straten's comment that my post was "badly researched" and "doesn't make much sense," I'll grant him the first point in that my research consisted entirely of reading an article in Der Spiegel. But I fear he didn't really understand what I was trying to say, which was that the U.S. has some major selling points that the doomsayers among us too often ignore. One is our top universities, which while they will almost sure to be rivaled by those of China and India in the future, currently dominate just about every world ranking I've ever seen. As for the English language, yes lots of universities and corporations in Europe have switched to using it, but they're still located in non-English-speaking-countries. And finally, I'm a big public transportation user myself, and I agree that the excellent transit systems of most big European cities are a selling point. But I think lots of people around the world put even more value on having their very own house with a yard, and American metropolitan areas offer this in unique abundance. UPDATE 2: Commenter Stuart T. of London correctly points out that most everything I say about U.S. strengths also applies to the U.K. (Which is why London ended up as Europe's financial center instead of Frankfurt.) He also says the Mercedes SLR McLaren was designed in the U.K. I think it's better described as a joint U.K.-German endeavor, but it still was clearly not the best example I could have chosen. How about the BMW M6? The Democrats are going to raise your taxes (in 2011)

During the just-concluded campaign, President Bush and other Republicans did what they could to convince voters that Democrats would raise taxes after the election. Voters didn't seem to believe them or care, and the soon-to-be leaders of the Democratic House and Senate have been doing their best to emphasize that tax raising isn't on their agenda (unless you consider the minimum wage to be a tax on employers of low-wage workers).

Here's a prediction for you, though: The Democrats are going to raise your taxes in 2011. Maybe they'll be politically astute enough to convince voters that it's really George W. Bush reaching back from retirement on the ranch to raise rates on top earners, capital gains, and dividends. But the effect will be the same. Your taxes will go up (and by "you" I mean Fortune and CNNMoney.com readers, who make a lot more money and are far more likely to own stocks than the average American). This will come about because of the weird way Bush and the then-Republican Congress designed the big tax cuts of 2001 and 2003. Most of the cuts will expire on Dec. 31, 2010 unless Congress votes to extend them. Then there's the estate tax, which barring Congressional action will disappear completely in If you assume that the 111th Congress will be controlled by the Democrats (it's a pretty safe bet that at least the House will be, given that it just doesn't change hands all that often), they'll be ones who would have to vote to extend the tax cuts in 2010 or before. And while House Ways and Means Committee Chairman-in-waiting Charlie Rangel has done his best over the past few months to make it entirely unclear what he wants to do about the expiring tax cuts (can you blame him?), I have a piece of pretty straightforward evidence that most of the cuts are probably history. This was the May 10 House vote to approve the Tax Relief Extension Reconciliation Act, which extended soon-to-expire cuts in dividend and capital gains taxes to 2010. The tally was 244 to 185, with 15 Democrats (Charlie Rangel not among them) crossing the aisle to vote with the majority and 2 Republicans going the other way. Assuming the same number of defections each way, in the new Congress the vote would be 216-209 against the tax cut extension. But the thing is, with Rangel as chairman of the Ways and Means Committee, it would probably never even come to a vote. Certain parts of the Bush cuts, like the new 10 percent bracket for the first few thousand dollars of taxable income, might come up for renewal. But I just don't see the Democratic leadership choosing to let Congress vote to extend tax cuts for people with high incomes and big stock portfolios. Do you? And here's the thing: You can't really blame them. The Bush tax cuts were, as these things go, pretty well designed. The capital gains and dividend tax cuts in particular would, if allowed to survive, probably have a positive effect on long-run economic growth. But by failing to even try to find a way to pay for these cuts (no, they don't pay for themselves) through spending cuts or hikes in other, less growth-inhibiting taxes (the gas tax!), President Bush may have doomed them. According to the projections of the Congressional Budget Office, just letting the tax cuts expire will reduce the deficit from $328 billion (2 percent of GDP) in 2010 to $54 billion (0.3 percent of GDP) in 2012. Accomplishing this kind of budget turnaround without ever having to bring it to a vote will be awfully tempting for whoever is running Congress in 2010, but especially if it's the Democrats. UPDATE: Thanks to several commenters who pointed out that I had the dates wrong on the pending death and rebirth of the estate tax. Daniel Ortega and the 1995 Managua rec-league baseball championship

My experience with Daniel Ortega, who looks set to become the next president of Nicaragua, is limited to having watched a couple of baseball games in 1995 on a Managua field adjacent to the gated compound where he was said to live. But even that might be ever-so-slightly instructive about what is to come next.

You may remember that, a quarter century ago, Ronald Reagan publicly fretted that Ortega's Sandinistas--who overthrew dictator Anastasio Somoza in 1979--were a mere two days drive from Harlingen, Texas, and presumably just waiting to impose their Communist ideas upon the Lone Star state. That was silly, but so were the American and European leftists who idealized Ortega as a beloved man of the people. When Nicaraguans voted in 1990, he got whomped by Violeta Chamorro. Since then Ortega hasn't gotten significantly more popular, but he has learned to work the electoral system. As part of a political deal to keep current president Enrique Bolanos from being impeached, the Sandinistas got the voting rules changed so that 35% of the vote plus a five-point lead over the next-highest vote getter was enough to win the presidential election outright (it used to take 45% to avoid a runoff, and Ortega always lost in the runoff). But back to those baseball games. They were the championship series of the Managua recreational league, a best-two-out-of-three affair that pitted the parliamentary press corps against what was then still called the Sandinista Popular Army (and was still run by Ortega's brother Humberto). The army team was made up of a bunch of scrawny teenagers from the countryside. In the first game they played in mismatched T-shirts and the trousers of their battle fatigues and were embarrassed by the pinstriped scribes, TV reporters, and cameramen. The crowd was very much on the journalists' side, and berated the handful of army officers present for the sorry state of their team. A week later, the army boys had uniforms (although several players were still shod in army boots, and none of their caps matched) and they won the first game of a double header. But they lost in the deciding game--on a spectacular pitching performance by a knuckleballing reporter who had been purged from his job on the political staff of the Sandinista-owned daily Barricada a few months before. The Sandinista army had been vanquished by the press, and was perfectly sporting about it. So now Daniel Ortega is on the verge of running Nicaragua again. My baseball-informed guess is that he won't do a very good job of it (it's hard to pull off a Hugo Chavez act without Hugo's oil), but that he will more or less abide by Nicaragua's laws, will maintain Nicaragua's membership in the Central American Free Trade Agreement, and will not invade Harlingen, Texas.

CNNMoney.com Comment Policy: CNNMoney.com encourages you to add a comment to this discussion. You may not post any unlawful, threatening, libelous, defamatory, obscene, pornographic or other material that would violate the law. Please note that CNNMoney.com makes reasonable efforts to review all comments prior to posting and CNNMoney.com may edit comments for clarity or to keep out questionable or off-topic material. All comments should be relevant to the post and remain respectful of other authors and commenters. By submitting your comment, you hereby give CNNMoney.com the right, but not the obligation, to post, air, edit, exhibit, telecast, cablecast, webcast, re-use, publish, reproduce, use, license, print, distribute or otherwise use your comment(s) and accompanying personal identifying information via all forms of media now known or hereafter devised, worldwide, in perpetuity. CNNMoney.com Privacy Statement.

|

|