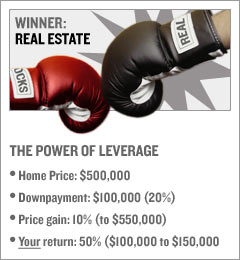

You know the math: You make a 20% down payment on a $500,000 house. Two years go by and the house increases in value to $550,000, or 10%. The return on your down payment - your real stake in the deal - is a stunning 50%, however.

What about stocks? Well, you can leverage them by buying on margin, but you can borrow no more than 50% of the purchase price. You could also play in the options market, but you risk losing your entire investment.

Of course, a lot of real estate fans who chased a quick buck in recent years are finding out about the other side of leverage. Suppose you put 5% down on a $250,000 condo in Las Vegas in 2005. You planned to rent the unit out for a while, then flip it. Now the condo glut there means that when you sell - if you can sell - you might get $220,000.

So you'd wind up minus your original investment and owe the bank $17,500 to boot. That's a sucker punch many people in formerly hot markets are feeling now.

Still, as a way to turn a small stake into a lot of money in a rising market (and home prices have generally gone up), you can't beat the leverage that real estate offers.