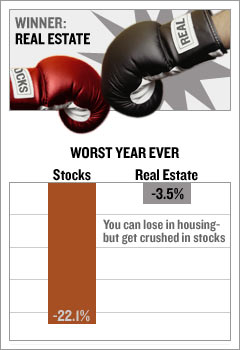

He's got a point. Because real estate takes so much time and effort to buy and sell, it rarely soars or plunges. The Francis-Ibbotson study, for example, found that over the 27 years surveyed, homes in their worst year returned 3.5% and commercial property lost only 5.6%.

The S&P 500's worst annual performance was a 22.1% decline. That doesn't mean you can't lose your shirt and everything else on real estate. Hartford, Houston and Los Angeles, for example, experienced 20%-plus price drops at some point since the '80s. But those declines unfolded over several years, and all three markets recovered.

On the other hand, we're still a ways from knowing whether the current slowdown in the housing market is about to end or is only getting started.