All in all, closing costs can run 2% to 4% of your purchase price. Sellers have to lay out a 6% commission for their agent, prepare a place for sale and, if it's their home, pay to move. Buying and selling can total about 10% of the purchase price.

Such costs make real estate a tough game. That $550,000 house (the one that gained 10% in two years) just turned into roughly a break-even proposition. And that total doesn't include the cost of maintenance and refurbishing, mortgage interest, taxes or insurance, which may add up to more than what you'd have laid out to rent a similar property.

Expenses run even higher if you are the owner of an investment property. You have to add the cost of advertising for tenants, evicting those who mess with you and carrying empty apartments.

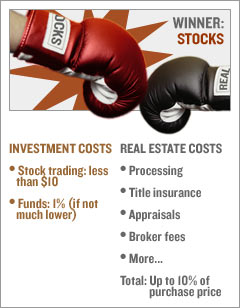

In their study, Francis and Ibbotson didn't deduct such costs when they calculated returns. Had they, real estate would have fared worse. Stocks, by comparison, are incredibly cheap to own and sell. At a discount brokerage such as Scottrade, you can pay anywhere from $7 for an online purchase to $27 for one that is broker assisted.

Same when you want to dump your stock. A mutual fund that tracks a broad index of stocks can cost you as little as 0.09% of assets a year.