|

Just the two of us The empty-nester challenge: Once the children are gone for good, you need to rethink your financial priorities.

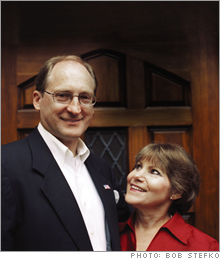

(Money Magazine) -- The next sound you hear will be that of Rosemary Jordan crying her eyes out. Ask for her recollections of the day her daughter left home for good, and her voice suddenly goes dead. "Uh-oh," warns Greg, her husband.

Through her sobs, Rosie then reconstructs the day last August when the younger of her two children, Jennifer, 22, a newly minted college grad, packed up her room and moved to Bloomington, Ind., 50 miles away from her parents' home in Indianapolis. "If you've done your job right as a parent, it's a good thing," Rosie sniffs. But knowing that the time was right for Jennifer to declare her independence doesn't make Rosie miss her any less. After three months, Rosie admits, "we still feel the void." There is one part of the child-rearing experience that the Jordans don't miss, though: the endless expenses that came with raising Jennifer and her brother Michael, 26 - the piano lessons, the extra-curricular activities and, of course, the college costs. "I don't miss writing all those tuition checks," declares Greg, 52, who estimates that he and Rosie, 54, spent $150,000 over the past eight years to put both of their children through Indiana University. Now here they are, home alone, suddenly with money to burn. In theory, anyway. "We're focused on saving for the future," says Greg, a former county treasurer who recently launched a business advising other counties on fiscal matters. Within the next five years or so, Rosie, a career counselor, hopes to retire from Eli Lilly, the pharmaceutical company where she's worked for the past 22 years, to become a career consultant. "I love what I do," Rosie says. "But there are other things to think about." Like, for example, themselves. Now that the kids are gone, says Greg, "our priorities are changing." How so? The Jordans want what most couples in their position desire: to make a success of this next chapter in their lives - in their case, to build second careers that give them more flexibility than their old ones; to make retirement a viable option within the next several years; and to feel fulfilled along the way. As with other empty-nesters, they have more disposable income to help meet those goals than they did when their children were living at home. The challenge is to put that money to its best use. Be selfish for a change Now that the children aren't your most pressing financial concern, what is? "You have got to start thinking in terms of looking out for yourself," advises David Twibell, president of wealth management at Colorado Capital Bank in Denver. The first order of business: Set up an aggressive schedule for paying off any non-mortgage debt you have - credit card balances, home-equity lines of credit, loans you took out to help put the kids through college. After all, retirement is looming closer, and you don't want to still owe money once the paychecks stop. Then sit down with your spouse and think through your other key goals, for the immediate future as well as the next several years: Do you hope to make an early exit from the work force or maybe launch a second career? Can you finally afford to renovate the kitchen? What about taking that trip to Europe you've always dreamed about? "When you become an empty-nester, you are at a new chapter in your life," says Alan Haft, a financial planner in Boca Raton, Fla. It's important to consciously plan for it, not just kinda, sorta let it happen. Get serious about saving for retirement Sure, it's tempting to reward all your diaper changing and soccer shouting with a 105-inch plasma TV. You've earned it. But rather than put your newfound extra disposable income into lifestyle improvements, you'll be better off using the bulk of it to kick your retirement savings into high gear. Studies show that people between the ages of 45 and 54 have saved, on average, less than $50,000. Yet it takes a cool $1 million or so to generate $40,000 to $50,000 a year in retirement income without having to worry about depleting your assets. Although the Jordans have almost no debt (they paid off their mortgage this summer) and have saved steadily for retirement (even while the kids were in college), they don't have enough set aside yet to maintain their lifestyle once they stop working. So they're now determined to max out every retirement account available to them, including taking advantage of catch-up provisions that allow folks over 50 to make extra contributions. This year you can put an additional $5,000 into a 401(k), for a total of $20,000, and an extra $1,000 into an IRA, for a total of $5,000. Move someplace cheaper One way to come up with extra cash for retirement and other goals: Downsize to a smaller home now that you no longer need as much space. Over a third of baby boomers do plan to move as soon as they become empty-nesters, according to a survey by housing developer Pulte Homes (Charts). The financial benefits can be substantial. Say you sell your home, buy a smaller place and net $150,000 in the process. Invest that money at age 55, and 10 years later you'll have nearly $325,000, assuming an average return of 8% yearly. You'll also probably save several thousand dollars annually in property taxes, and, of course, the new digs will be cheaper to maintain. Cut the cord You won't get to pocket that extra money, however, if you just turn around and spend it on your kids. About a third of adults ages 18 to 34 get financial help from their parents, typically amounting to a few thousand dollars a year, according to a University of Michigan study. Sure, it's hard to say no to your child, even when that child is 25 years old and is five inches taller than you are. But it's also necessary (occasional gifts notwithstanding). By bailing out your adult kids, you delay their learning how to manage money on their own (including the No. 1 lesson: If you can't afford it, you can't have it). And you rob yourself of money you need for retirement and other goals. The Jordans, for instance, made it clear to their kids when they were still at home that Mom and Dad would not foot the bills once they were out of college. To make sure Michael and Jennifer had the budgeting skills they'd need as adults, Rosie insisted they pay for such amenities as pizza and clothing out of money they earned at summer jobs while they were in college. And although the Jordans own the condo that their daughter now lives in, Jennifer pays all of the expenses. Have some fun No doubt, financial planning for life after kids takes work. But that doesn't mean empty-nesters have to lead monastic lives. You're free, remember? Even the Jordans let themselves feel it. This fall, when a group from church invited them along on a Caribbean cruise in January, they quickly plunked down the $3,000 that was required. "We'll miss the kids," says Rosie. "But we won't feel guilty." ________________________ |

|