Regulators: CIT, heal thyself

The struggling lender signs another deal with federal bank overseers calling for improvements in its boardroom and on its books.

|

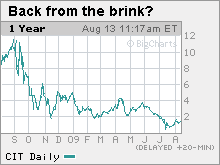

| CIT shares have soared of late despite the lender's poor outlook. |

NEW YORK (Fortune) -- CIT, the small business lender whose bid for fresh bailout money recently was rebuffed, got another rap on the knuckles from regulators.

The New York-based finance company said Thursday it signed a written agreement with the Federal Reserve Bank of New York. The agreement calls for CIT (CIT, Fortune 500) to strengthen its management and risk oversight, submit a plan to raise capital and fix its loan loss accounting.

Among other things, the deal calls for CIT to devise a plan "so that compensation and other incentives provided to senior management and other employees are risk sensitive and aligned with the long-term prudential interests" of the company.

The order doesn't identify any employees whose compensation is misaligned. But the agreement was signed by CEO Jeff Peek, who has made $36 million since 2004 for leading the company to the brink of bankruptcy.

The written agreement comes a month after CIT's banking unit consented to a cease-and-desist order with the Federal Deposit Insurance Corp. over the liquidity problems at CIT. Like the Fed agreement, that order restricted the company's ability to pay dividends and called on management to present regulators with future operating plans.

CIT is trying to restructure itself with the help of bondholders who now effectively control the company. Running low on cash after being shut out of the bond markets, CIT last month asked the government for a second round of federal aid on top of the $2.3 billion the company received in December from Treasury's Troubled Asset Relief Program.

Despite popular resentment of bailout deals, talk of a CIT rescue won some support among those who argued the company is a vital cog in financing small businesses that can't get loans from banks.

But officials told the company not to expect any more help, prompting CIT to strike a deal with its creditors in a last-ditch bid to avoid bankruptcy. The company got $3 billion, but the cash came at a steep price: CIT is paying 13% annually, plus fees, for the borrowings, and had to pledge essentially all its assets as security for the loan.

CIT is in the midst of completing a tender offer for $1 billion in outstanding notes that will remove the immediate threat of bankruptcy. The company also said Thursday that it adopted a plan to discourage investors from accumulating more than 5% of its shares, in the name of preserving the value of the the tax losses that might be used one day to offset future earnings.

Shares of CIT, which traded as low as 31 cents each a month ago, rose 21 cents Thursday to $1.49.

Still, the company remains deeply troubled. CIT said Tuesday it would be late in filing its second-quarter financials with regulators, as management has been trying to complete a draft of its restructuring plan by Friday. CIT expects to lose at least $1.5 billion for the second quarter.

Analysts expect to see the company seek to reduce its debt load by swapping existing bonds for new debt and shares in the revamped company. Even if those efforts go forward, though, CIT -- which like many finance companies made money by borrowing at low rates in the short-term credit markets and lending it out at higher rates to customers -- still faces significant questions.

"The company's funding strategy and liquidity position have been materially adversely affected by on-going stress in the credit markets, operating losses, credit ratings downgrades, and regulatory and cash restrictions such that there is substantial doubt about the company's ability to continue as a going concern," CIT said in its filing Tuesday. ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More