Jittery day on Wall Street

Stocks end lower, after falling sharply in the previous session, as worries about the pace of an economic recovery keep investors sidelined.

|

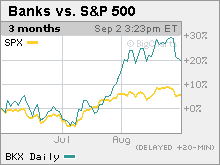

| The KBW Bank index gained 20% this summer, while the broad S&P 500 gained 11%. |

|

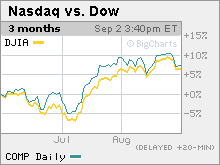

| The Nasdaq rose 13.2% in the June through August period while the Dow gained 11.7%. |

NEW YORK (CNNMoney.com) -- Stocks slipped Wednesday, ending a choppy session lower following the previous day's battering as nervous investors continued to worry that the market rally may have outpaced any recovery.

The Dow Jones industrial average (INDU) lost 30 points, or 0.3%. The S&P 500 (SPX) index slid 3 points, or 0.3%. The Nasdaq composite (COMP) managed a tiny gain of 2 points, or 0.2%.

Stocks seesawed throughout the session Wednesday as investors mulled a pair of unemployment reports that signaled the pace of job cuts was moderating, ahead of Friday's bigger August jobs report.

With little else on tap to provoke investors in any direction, trading remained largely rangebound.

The 2 p.m. ET release of the minutes from the last Fed meeting failed to propel markets in either direction. The minutes showed the central bankers thought the economy was stabilizing, after weakening in 2008 and early 2009, and that construction was starting to pick up, which is a good sign for the housing market.

The bankers also discussed the need to keep refining the Fed's so-called exit strategy after injecting billions into the financial system to help manage the meltdown.

"Investors have built in a lot of the numbers we've been seeing showing economic improvement," said Haag Sherman, managing director at Salient Partners. "What they want to see now is some of that improvement manifesting in topline growth for businesses, not just cost cutting."

Second-quarter earnings were generally better than expected, due to trimming costs, but revenue growth was moderate.

Thursday preview: The nation's chain stores will be releasing August sales info throughout the morning. Investors will be looking to see if the stock rally and signs of recovery in the economy have had any impact on consumer spending.

The Institute for Supply Management's services sector index for August is also due in the morning, along with the weekly jobless claims report.

Rally running out of steam: Stocks slumped on Tuesday, with the three major gauges all losing around 2% as investors bet the six-month run has gotten ahead of the economic rebound.

Since bottoming on March 9 at a 12-year low, the S&P 500 has basically been on the rise, adding 52% through Monday. Stocks saw a minor retreat in late June and early July, with the S&P 500 losing about 7% heading into the start of the second-quarter financial reporting period. But other than that small selloff, the direction has mostly been up.

Reports on Tuesday showed housing and manufacturing are recovering, but investors remain worried about the labor market and how rising joblessness will impact consumer spending. Consumer spending fuels two-thirds of economic growth, and economists say any recovery will be mild without the consumer's participation.

Jobs: Two reports on the labor market were released Wednesday morning, two days ahead of Friday's bigger non-farm payrolls report.

Payroll services firm ADP said employers in the private sector cut 298,000 jobs from their payrolls last month after cutting a revised 360,000 in July. Economists were expecting 250,000 job cuts according to a Briefing.com survey.

Separately, outplacement firm Challenger, Gray & Christmas reported 76,456 job cut announcements in August, 21% fewer than in July.

Although both reports indicate the pace of job cuts has slowed, the economy is still shedding jobs.

"An abatement in job losses is a far cry from a turnaround in the labor market," Sherman said.

However, many economists were forecasting no abatement or improvement until later this year or early next.

"The reports show that the labor market is progressing toward the recovery phase ahead of schedule," said Gregory Miller, chief economist at SunTrust Banks.

He said that if the pace of the recovery in the jobs market continues - and business spending picks up - the recovery could be be stronger than current forecasts. But without those two factors, growth will remain sluggish.

Other economic news: A Labor Department report showed that non-farm productivity rose at a 6.6% annual rate during the second quarter versus the initially reported 6.4% pace. That was in line with forecasts.

Factory orders rose 1.3% in July, the Commerce Department reported. Orders rose a revised 0.9% in June. Economists thought orders would rise 2.2% in July.

Company news: Wells Fargo (WFC, Fortune 500) is set to repay the $25 billion in bailout funds it took from the U.S. government. The bank expects to pay it back from internal funds, rather than through issuing new shares.

Financial stocks as a sector retreated for the second session in a row, although the declines were fairly modest.

The KBW Bank index lost nearly 8% in Tuesday and Wednesday's sessions after rallying 20% in the three months ended Aug. 31. The financial sector rallied through the summer on a mix of speculation and momentum.

Pfizer (PFE, Fortune 500) will plead guilty to a criminal charge related to how it promoted now-defunct pain killer Bextra. The Dow component will pay $2.3 billion to settle charges it wrongly marketed 13 medicines. In January, Pfizer said it took the charge but didn't specify why.

Shares of Sepracor (SEPR) rallied 26.5% on published reports that Japan's Dainippon Sumitomo Pharma plans to make a $2.7 billion bid for the drugmaker.

Fellow Dow component Coca-Cola (KO, Fortune 500) rallied, while JPMorgan (JPM, Fortune 500), Merck (MRK, Fortune 500), Walt Disney (DIS, Fortune 500) and Home Depot (HD, Fortune 500) declined.

Diversified manufacturer Danaher (DHR, Fortune 500) said it is cutting more jobs as part of its restructuring plan -- and is buying two businesses that make scientific instruments for about $1.1 billion.

The company is buying the life sciences instrument business of Canadian MDS for $650 million in cash. That purchase includes a 50% stake in AB SCIEX, which makes instruments used by researchers. Danaher will also buy the rest of AB SCIEX for $450 million. Danaher shares gained 2%, while MCS (MDZ) shares gained 32%.

Oil: U.S. light crude oil for October delivery settled at $68.05 a barrel on the New York Mercantile Exchange after a mixed weekly inventory report from the Energy Information Administration. The settle price was unchanged from the previous session. Oil prices have been slipping since hitting a 10-month high just below $75 a barrel late last month.

In other energy sector news, BP (BP) said Wednesday that it has made a "giant" oil discovery in the Gulf of Mexico. Although the company doesn't yet know the volume of oil present, it is thought to be in excess of 3 billion barrels.

Gold: COMEX gold for December delivery rose $22 to settle at $978.50 an ounce.

That gave a boost to a variety of metal and mining companies, including Goldcorp (GG), Barrick Gold (ABX) and Yamana Gold (AUY). Yamana announced a quarterly dividend of a penny per share after the close of trade Tuesday.

World markets: The global market selloff continued, with Asian shares slumping. The Japanese Nikkei lost 2.4%. In Europe, markets tumbled as well.

Bonds and currency: Treasury prices rose, lowering the yield on the benchmark 10-year note to 3.29% from 3.36% late Tuesday. Treasury prices and yields move in opposite directions.

In currency trading, the dollar fell versus the euro and the Japanese yen.

Market breadth was negative. On the New York Stock Exchange, losers beat winners three to two on volume of 1.38 billion shares. On the Nasdaq, decliners narrowly edged advancers on volume of just under 2 billion shares.

How does your portfolio look nearly one year after the collapse of Lehman Brothers? What investment choices hurt you or helped you the most? What strategy changes are you making for the future? Tell us your story. E-mail realstories@cnnmoney.com and your thoughts could be part of an upcoming story. For the CNNMoney.com Comment Policy, click here. ![]()

Small business staff cuts

A market that healed itself

Preparing for a major bank shakeout

Stocks led by four wounded horsemen

Bernanke: Fed's unlikely risk taker

New home sales blast past expectations

100 Fastest-growing companies

America's best places to live

50 years of profit swings