Three-peat: Stocks fall again

Weaker-than-expected readings on durable goods orders and new home sales weigh on markets, capping a losing week for Wall Street.

NEW YORK (CNNMoney.com) -- Stocks fell for the third straight session on Friday, ending lower for the week, after weaker-than-expected reports on durable goods orders and new home sales sparked concerns about the strength of any recovery.

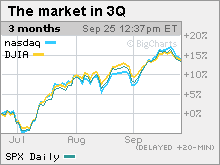

The Dow Jones industrial average (INDU) lost 42 points, or 0.4%. The S&P 500 (SPX) index lost 6 points, or 0.6%. The Nasdaq composite (COMP) fell 17 points, or 0.8%.

Stocks slid in the previous two sessions after having ended Tuesday at one-year highs. Investors reacted negatively to Wednesday's Federal Reserve meeting and Thursday's weaker existing home sales report and oil slump.

The mix of economic news Friday gave investors another reason to retreat after the recent advance. An attempt at stabilizing in the last hour of trading gave out near the close.

"Today is the third day that we are seeing selling on higher volume," said Curtis Lyman, managing director at HighTower Advisors. "It's indicative that the market is consolidating after the very nice recovery we've seen."

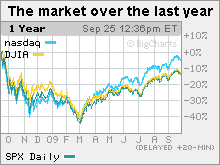

Stocks have seen a huge spike over the last 6-1/2 months. Since bottoming at a 12-year low March 9, the S&P 500 has gained 54.4% and the Dow has gained 47.6%, as of Friday's close. After hitting a six-year low, the Nasdaq has gained 64.8%.

This week's retreat has left Wall Street at what could be a key inflection point, said Brian Peardon, wealth advisor at Harrison Financial Group

"We could see a new push higher or a much more substantial selloff," Peardon said. "It's just a matter of all the cash on the sidelines and whether the (buy on the) dip buyers decide to come in."

He said that a continued move higher is more likely than a big selloff at this point, but that the upcoming quarterly earnings reporting period will be critical in terms of whether the rally gets another leg up.

Economy: New home sales rose 0.7% in August to a 429,000 unit annual rate from a 426,000 unit rate in July, according to a government report released Friday morning. It was the fifth consecutive month of rising sales.

The results were shy of the 440,000 unit annualized rate economists were expecting, according to a survey by Briefing.com.

In general, the report added to other recent indications that the housing market has likely hit bottom. The housing market collapse and subsequent subprime mortgage meltdown were seen as sending the economy into recession in the first place, so a recovery in this area is critical for broader growth.

But not all signs point to improvement. A different report Thursday from the National Association of Realtors showed August sales of previously-owned homes fell 2.7% in August from July, after jumping in the previous month.

Another report released Friday showed that consumer sentiment rose more than expected in September. The University of Michigan's index rose to 73.5 from an initial reading of 70.2. Economists thought it would rise to 70.5.

An earlier report showed a surprise drop in durable goods orders last month. Orders for big-ticket items meant to last three years or more fell 2.4% in August versus forecasts for a rise of 0.4%, the Commerce Department reported. The surprise dip was largely due to a drop in commercial aircraft orders. Orders rose a better-than-expected 4.8% in July, including the impact of the Cash for Clunkers auto stimulus program.

Stripping out autos, August orders were flat versus forecasts for a rise of 1%. Orders excluding autos had risen 0.9% in July.

"We're seeing continued choppiness in the economic numbers, which points to the fact that the recovery is still in the early stages," Lyman said.

G-20 summit: The Group of 20 leading developed and emerging countries met for a second day in Pittsburgh. The Group has been meeting to discuss the financial crisis and how to prevent something like it from happening again.

On Thursday, the leaders agreed to make the group the new permanent council for international economic cooperation, essentially eclipsing the G-8, which doesn't include developing nations such as China, India or Brazil.

The G-8 will still meet on major security issues, but will be less influential.

Company news: Research in Motion (RIMM) reported a better-than-expected profit late Thursday, and also forecast third-quarter earnings in a range that includes analysts' estimates. But the BlackBerry maker also predicted third-quarter revenue would fall in a range that is short of analysts' current estimates. Shares slumped 17%.

After the close Thursday, Hewlett-Packard (HPQ, Fortune 500) issued a fiscal 2010 revenue forecast that is short of analysts' predictions and an earnings outlook in a range that could top analysts' expectations. On a broader level, the computer and printer maker said that the IT industry will return to growth next year and that the company will outpace the rest of the market. Shares were little changed.

In deal news, Unilever (UN) is buying Sara Lee (SLE, Fortune 500)'s personal care unit for $1.88 billion, the companies said Friday.

A number of retailers declined on concerns about the economy, including Wal-Mart Stores (WMT, Fortune 500).

World markets: Global markets were mostly lower. In Europe, London's FTSE 100 ended little changed, while France's CAC 40 and Germany's DAX both declined. Asian markets ended lower, with the exception of the Japanese Nikkei.

Currency and commodities: The dollar fell versus the euro and the yen. The greenback has repeatedly hit one-year lows against a basket of currencies over the last few weeks.

The weaker dollar had little impact on dollar-traded commodities, although it often moves in the opposite direction of oil and gold prices.

U.S. light crude oil for October delivery rose 13 cents to settle at $66.02 a barrel on the New York Mercantile Exchange.

COMEX gold for December delivery fell $7.30 to settle at $998.90 an ounce. Gold closed at a record high of $1,020.20 last week.

Bonds: Treasury prices rose, lowering the yield on the benchmark 10-year note to 3.32% from 3.36% late Tuesday. Treasury prices and yields move in opposite directions.

Market breadth was negative. On the New York Stock Exchange, losers topped winners eight to seven on volume of 1.20 billion shares. On the Nasdaq, decliners beat advancers five to four on volume of 2.39 billion shares. ![]()

G-20 summit: 6 countries in recovery

Fed: Economic activity has 'picked up'

Bankrolling Detroit's turnaround

Dow approaches 10,000. Again.

Ranking the rescues

Fighting off the Bear: Seven stories

5 lessons from the crash

50 Most Powerful Women

Bernanke: Fed's unlikely risk taker

100 Fastest-growing companies

50 years of profit swings