Nasdaq slumps, Dow snaps slide

A surprisingly weak reading on consumer confidence and selling in banks, techs and retailers weigh on the composite. Strong energy sector gives the blue-chip indicator a lift.

NEW YORK (CNNMoney.com) -- The Nasdaq slumped and the Dow managed a slim gain Tuesday, as investors weighed a selloff in tech, a rally in energy and a surprise drop in consumer confidence.

A better-than-expected housing market report and a strong response to the government's latest debt auction were also in the mix.

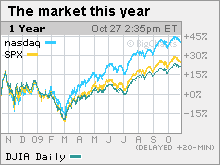

The Dow Jones industrial average (INDU) gained 14 points, or 0.1%. The S&P 500 (SPX) index rose 3 points, or 0.3%. But the Nasdaq composite (COMP) lost 26 points, or 1.2%.

Since peaking at rally highs a week ago, the Dow has lost 2.3%, the S&P 500 has lost 3.4% and the Nasdaq has lost 3.4% through Tuesday's close.

"In the last few days, the market hasn't been looking very friendly, but the overall picture hasn't changed much," said Will Hepburn, president at Hepburn Capital Management. "The upward momentum is still significant."

Hepburn said that there's still plenty of fuel to keep the advance going. He cited the improving economic and corporate news, the massive amounts of government stimulus and the trillions sitting in money-market funds in cash or low-yielding bonds.

He noted that although the S&P 500 is up 57% from the March bottom, when it hit a 12-year low, the broad average is still down 32% from its all-time high of October 2007.

Tuesday's market: Weakness in banks, techs, retailers and transportation stocks dragged down the Nasdaq and limited the rest of the market from moving much. Cisco (CSCO, Fortune 500), Dell (DELL, Fortune 500), Amazon.com (AMZN, Fortune 500) and Yahoo (YHOO, Fortune 500) were among the Nasdaq's biggest decliners.

A rally in heavily weighted Dow components Chevron (CVX, Fortune 500), Exxon Mobil (XOM, Fortune 500), DuPont (DD, Fortune 500) and American Express (AXP, Fortune 500) kept the blue-chip measure afloat.

Stocks tumbled Monday, with the Dow dropping 100 points for the second day in the row. A spiking dollar dragged on commodity shares and other stocks that benefit from a weak U.S. currency.

The dollar and commodity prices remained in focus Tuesday. But investors also looked to the economic news ahead of Thursday's highly anticipated gross domestic product report.

Energy: Energy was the strongest sector on the day, as investors reacted to a smattering of financial reports and the impact of the U.S. dollar.

European oil behemoth BP (BP) reported weaker quarterly earnings and revenue due to lower oil prices, but the results topped analysts' estimates. BP's U.S.-traded shares rose 4%.

Valero Energy (VLO, Fortune 500), the largest U.S. oil refiner, reported a bigger-than-expected quarterly loss Tuesday, with fuel demand suffering amid the sluggish economy. Shares fell 4.3%.

Nonetheless, a variety of energy stocks rallied, including Dow components Chevron and Exxon Mobil.

Raw commodity prices were higher as well, despite a mixed dollar. Typically a weak dollar boosts dollar-traded commodity prices and a strong dollar pressures prices.

Confidence: Consumer sentiment took a plunge in October, according to a Conference Board report released after the start of trading. The Consumer Confidence index fell to 47.7 in October from a revised 53.4 in September, reflecting the impact of rising joblessness and shrinking household wealth. Economists surveyed by Briefing.com thought the index would rise to 53.5.

The part of the index that measures how consumers rate the present economic situation fell to 20.7 in October from 23 in September. It was the lowest level since February 1983, when it stood at 17.5.

Housing: Home prices rose for the fourth month in a row in August, according to the S&P Case-Shiller Home Price index of the 20 largest metropolitan areas. Prices also showed the smallest year-over-year declines in nearly 2 years.

Prices rose 1.2% in August after climbing 1.6% in July. Versus a year ago, prices were down 11.3%, but that was shy of the 11.9% drop economists were expecting.

Financial results: With 230 companies, or 46%, of the S&P 500 having already reported results, profits are on track to have fallen 18.1% from a year ago, according to the latest from Thomson Reuters.

Results have largely topped forecasts, with 80% of companies beating earnings' estimates, 6% meeting expectations and 13% missing forecasts.

Currency and commodities: The dollar gained versus the euro, after falling to a 14-month low last week. But the greenback fell versus the yen.

U.S. light crude oil for December delivery rose 87 cents to settle at $79.55 a barrel on the New York Mercantile Exchange.

COMEX gold for December delivery fell $7.40 to settle at $1,035.40 an ounce. Gold has surpassed records repeatedly this month due to the weak dollar and longer-term worries about inflation.

World markets: Global markets were mixed. In Europe, London's FTSE 100 added 0.2%, France's CAC 40 was barely changed and Germany's DAX lost 0.1%. Asian markets ended lower.

Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 3.47% from 3.55% late Monday. Treasury prices and yields move in opposite directions.

Gains accelerated after the government saw strong demand for its sale of $44 billion in 2-year notes.

Market breadth was negative. On the New York Stock Exchange, losers beat winners by almost two to one on volume of 1.39 billion shares. On the Nasdaq, decliners topped advancers by over two to one on volume of 2.42 billion shares. ![]()

Dimon defends dollar - and JPMorgan

Risk is back

Main Street banks still bleeding

Clock ticking on debt ceiling

Saving their homes: Did Obama help?

Like it or not, here comes more stimulus

Where are the jobs?

40 under 40: Hottest rising stars

Millions of homes to get smart meters

Medicare boycott gains momentum

Why we don't hate Wal-Mart anymore