Dump the dollar! Buy gold!

Chris Pia, a master trader and Moore Capital alumnus, explains the market.

|

| Chris Pia sees gold as a smart play during both market crises and booms when investors think stocks are overvalued. |

| MMA | 0.69% |

| $10K MMA | 0.42% |

| 6 month CD | 0.94% |

| 1 yr CD | 1.49% |

| 5 yr CD | 1.93% |

(Fortune magazine) -- Back in 1988, long before Louis Bacon became the secretive hedge fund billionaire atop Moore Capital, he was walking the trading floor at Shearson Lehman when he spotted Chris Pia, a burly 21-year-old recruit.

The jazzy graphics Pia was running on his computer impressed Bacon, and the kid knew a bit about commodities, having spent the past five summers clerking on the COMEX "while my friends tended bar at Jones Beach."

So Bacon, who had just been given $20 million of Shearson's capital to trade, told Pia, "I want you to do the same kind of charts for my trading operation." Pia jumped at the chance to work with Bacon at Shearson.

Two years later, when Bacon launched Moore Capital, he brought Pia with him. Over the next 18 years the protégé helped Bacon build Moore into a fund with more than $10 billion under management, thanks to the firm's ability to predict changes in the prices of commodities and currencies. As a portfolio manager at Moore, Pia delivered a sevenfold return from 1996 to 2008.

In November 2008, Pia left Moore Capital to start his own fund with Joe Niciforo, a former partner of Bacon rival Paul Tudor Jones. And here, speaking publicly for the first time, Pia tells Fortune how he raised $800 million as investors fled hedge funds, the trading lessons he learned alongside Bacon, and his tips for making money in the dollar, gold, and oil.

Pia, now 43, credits Bacon with teaching him the most important skill in trading -- risk management. "Louis taught me to get out when the market moves against you by even a modest amount and to avoid getting emotionally attached to your positions," he says.

These days Pia sells any position that drops 3%, even when the fundamentals appear in his favor -- a strategy that helped his fund at Moore thrive in 2008, a year when many hedge funds collapsed. By 2008 the investor assets that Pia personally oversaw at Moore had ballooned to more than $1 billion. (Over the years Bacon did well too: His own holdings now include a private island near the Hamptons, a grousehunting lodge in Scotland, and homes in Colorado and the Bahamas.)

Still, raising money in 2009 for Pia's own fund was complicated by the credit crisis and the Madoff scandal. Pia's first major investors were wealthy families from Switzerland, including big players from the gold-refining business: "They put in $250 million, which was amazing, considering that Geneva got killed by the Madoff fraud."

Pia bases his positions on long-term trends, but he typically holds investments for between three weeks and three months.

The dollar: Down 10% vs. euro

Pia predicts that the dollar will take a double hit: First, China and other Asian exporters to the U.S. are already maxed out on dollar reserves from the ever-rising sales of their exports and the interest on the Treasuries they've been buying with their dollars. In addition, those exporters will diversify into gold and the euro as they fret about U.S. inflation.

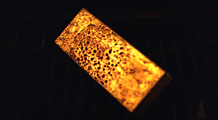

Gold: To $1,300+ an ounce

Pia now sees gold as a smart play during both market crises and booms when investors think stocks are overvalued. Other drivers include central banks' decreasing their dollars as a reserve currency in favor of bullion (as India did in early November), and gold's populist appeal: "Joe Investor understands gold much better than, say, IBM stock."

Oil: $70 - $100 a barrel

Cheap oil no longer equals a healthy economy: "Oil now goes up with stocks, and prices rise with growth," says Pia. He predicts that oil will swing between $70 and $100 a barrel, so investors should buy it toward the low end of that range and exit as soon as prices hit triple digits. "At $100," says Pia, "rig and pipeline construction booms. New oil supply comes out of the woodwork, and prices fall sharply." ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More