Wall Street retreats

Stocks drop as global markets slip, dollar firms up and commodities slide. Obama unveils new job stimulus effort.

NEW YORK (CNNMoney.com) -- Stocks tumbled Tuesday, with the Dow losing over 100 points as investors eyed weak global markets, a rising dollar, falling oil and gold prices, and some disappointing profit news from 3M, McDonald's and Kroger.

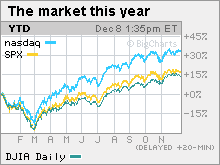

The Dow Jones industrial average (INDU) tumbled 104 points, or 1%. The S&P 500 index (SPX) lost 11 points, or 1%. The Nasdaq composite (COMP) shed 17 points, or 0.8%.

Stocks slipped right out of the gate as investors took a cue from falling global markets and a rising dollar. Reports in the U.K. and Germany showed manufacturing is still weak, while Japan approved $81 billion in stimulus money, and ratings agencies warned about debt problems in Dubai and Greece.

The rising dollar also played a role in the stock weakness. The weak dollar has added to stock gains over the last nine months, but for the last two weeks, the greenback has started to make a comeback versus the euro. The U.S. dollar has remained weak against the yen.

A stronger dollar pressures dollar-traded commodities and commodity stocks, as well as companies that do a lot of business overseas and therefore benefit from a weak U.S. currency.

"Over the last several months, the weakening dollar has definitely led the market higher, but historically a weak dollar isn't good for stocks over the long term," said Tim McCandless, senior equity analyst at Bel Air Investment Advisors.

He said that in addition to reacting to the stronger dollar, stock investors are getting into end-of-the-year mode and "battening down the hatches" in the last weeks of a tough year.

Since hitting a more than 12-year low on March 9 at the height of the financial market panic, stocks have been on the rise, gaining 60% through Monday's close.

Stocks ended mixed Monday as comments from Federal Reserve Chairman Ben Bernanke cooled worries about higher interest rates but failed to overshadow the stronger dollar and weaker commodities.

Global markets: Overseas markets plunged after reports in Germany and the United Kingdom showed weakness in the manufacturing sector continues. The London FTSE 100 and the German DAX both lost 1.7% and France's CAC 40 lost 1.4%. Asian markets slipped after the Japanese government approved $81 billion in stimulus to help bolster the sluggish economy.

Debt worries: Dubai debt worries resurfaced after a credit rating agency reportedly cut its ratings on six Dubai state-connected companies.

Global investors got a jolt late last month after the Dubai government asked to defer payments for at least six months on $60 billion in debt owed by Dubai World, the city-state's main investment arm, and Nakheel, its real estate arm.

Elsewhere in the world, Fitch reportedly lowered Greece's credit rating Tuesday on debt concerns.

Company news: Dow component 3M (MMM, Fortune 500) issued a 2010 profit forecast in a range that meets or beats analysts' expectations. The diversified conglomerate also reiterated that 2009 earnings would fall in a range of $4.50 to $4.55 per share versus analysts' forecasts of $4.57. Shares fell 1%.

Fellow Dow component McDonald's (MCD, Fortune 500) said sales at U.S. stores open a year or more, a retail metric known as same-store sales, fell 0.6% in November, the second monthly decline in a row. Shares fell 2.1%.

Kroger (KR, Fortune 500) said it swung to a fiscal third-quarter loss from a profit a year ago. The grocery store chain also cut its full-year forecast and cut its target for same-store sales growth. Shares fell 12%.

Procter & Gamble (PG, Fortune 500) Chairman A.G. Lafley is retiring in January, the company said Tuesday. His position will be filled by Bob McDonald, the company's CEO. McDonald replaced Lafley as CEO in July.

General Motors may pay back all $6.7 billion in loans it owes the government in one lump sum, rather than on a quarterly basis as is currently expected, new chief executive Ed Whitacre said Tuesday.

FedEx (FDX, Fortune 500) shares rallied after it said fiscal second-quarter earnings will top forecasts, thanks to strength in international demand.

Obama and jobs: President Obama outlined a new multi-billion dollar jobs plan and stimulus proposal late Tuesday morning, in a speech at the Brookings Institution in Washington.

Obama said he wants to expand tax breaks for small businesses, invest in infrastructure profits and give consumers rebates for making their homes more energy efficient. Funds would come from the $200 billion in unallocated bailout money - some of which would also be used to pay down the deficit.

The dollar and commodities: The dollar fell versus the euro late in the day, erasing gains. The dollar gained against the yen.

COMEX gold for February delivery fell $20.60 to settle at $1,143.40 an ounce. Gold closed at an all-time high of $1,218.30 an ounce last week.

U.S. light crude oil for January delivery fell $1.31 to settle at $72.62 a barrel on the New York Mercantile Exchange.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.38% from 3.43% late Monday. Treasury prices and yields move in opposite directions.

Market breadth was negative. On the New York Stock Exchange, losers beat winners two to one on volume of 1.18 billion shares. On the Nasdaq, decliners topped advancers by two to one on volume of 2.01 billion shares. ![]()