Search News

NEW YORK (Fortune) -- The Federal Reserve raised the rate it charges banks that borrow from the central bank when they run short of funds.

The Fed said late Thursday it is raising its discount rate by a quarter percentage point, or 25 basis points, to 0.75%. The central bank said in a statement it made the move in response to improving financial market conditions.

|

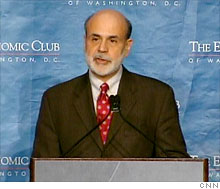

| Ben Bernanke's Fed is taking a small step toward normal policy. |

The move is largely symbolic, because banks do little borrowing at the discount window.

The unanimous decision to boost the discount rate also has no effect on the more widely watched federal funds rate, which measures the rate banks charge each other for overnight loans. That rate is expected to remain between 0% and 0.25% for the foreseeable future, given the slack in the labor market and the still fragile state of the economy.

But raising the discount rate allows Federal Reserve chairman Ben Bernanke to take another small step toward normal monetary policy, after the past two-plus years were consumed in a financial firefight.

"The modifications are not expected to lead to tighter financial conditions for households and businesses and do not signal any change in the outlook for the economy or for monetary policy," the Fed said in a statement.

The Fed also shortened the term of some discount window loans and raised the minimum bid in the term auction facilities it uses to supply overnight funds to banks. Those facilities were among the many innovations Bernanke introduced since the onset of the credit crunch in mid-2007 to supply U.S. banks with funding.

As the recession deepened, the Fed moved to support the housing market by buying more than $1 trillion of mortgage-related securities. When buying those securities, the Fed credited the selling banks with reserves at the Fed. This huge sum of so-called excess reserves has led to worries that any upturn in the economy will be met with an inflationary lending spike from banks.

Bernanke has emphasized that the Fed will use multiple new tools to prevent the excess reserves from fueling inflation, including the payment of interest on reserves at the Fed and the sale of Fed assets.

But as eager as policymakers are to show that policy is on a track toward normalization -- that is, a nonzero fed funds rate and a smaller Fed balance sheet -- the process is clearly going to take time.

The Fed suggested as much Thursday, in explaining why it may be a while before the spread between the federal funds rate and the discount rate may return to its pre-crisis level of 1 percentage point. Following Thursday's increase, the spread is now half a percentage point.

The central bank said Thursday's increase should "encourage depository institutions to rely on private funding markets for short-term credit and to use the Federal Reserve's primary credit facility only as a backup source of funds" and added that it will "assess over time whether further increases in the spread are appropriate." ![]()

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |