Search News

NEW YORK (Fortune) -- The Greek crisis has thrown another detour into the euro's march to world currency domination.

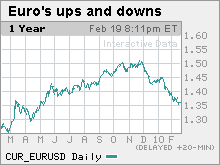

The rise of the European common currency has been a market theme for years. At its peak early in the financial crisis, the euro had gained 59% against the dollar since its inception in 2000, thanks to the European Central Bank's inflation-fighting mandate and years of lax policy in the United States.

|

| The euro has recovered from its 2008 lows but appears headed for more turbulence. |

The dollar's extended decline, together with huge loan losses in the U.S. banking system and anxiety among foreign creditors about the value of their Treasury holdings, seemed in mid-2008 like a recipe for the euro to overtake the fallen greenback as the world's reserve currency.

Yet the case for the euro has weakened markedly since then. The euro cratered at the end of 2008 and plunged again this year as debt default worries took hold in Greece. Economic and political stress in Europe stand to rise further this year as policymakers struggle with the debt problem.

All this gives further pause to those unhappy with long-term fiscal picture in this country who would like to hedge against future declines in the dollar.

"Doubts about the euro area mean people will worry about the value of the euro," said Menzie Chinn, an economics professor at the University of Wisconsin. "I wouldn't expect to see a big impact, but for a while you're going to have some questions."

The immediate questions center on how powerful European states such as Germany will deal with rising financial distress in Greece, Spain, Italy and Portugal.

Greece, facing a damaging spike in interest rates on its debt amid questions about its finances, has until March 16 to show the European Union it is making progress in cutting its budget deficit from nearly 13% of gross domestic product, more than four times the allowed level.

Officials have said they will support Greece, but they haven't said how. This has some skeptics of the euro project wondering if the rich, thrift-minded EU states ultimately can be counted on to come to the aid of poorer and heavily indebted ones.

"They can choose solidarity or chaos," said David Marsh, author of The Euro: The Politics of the New Global Currency. "They are more likely to choose solidarity, but there is no certainty."

Any number of things could change in the euro zone in the next few years, Marsh said, depending on the terms offered debtors like Greece. He cites prospects ranging from smaller countries dropping out to a split of the EU into northern and southern regions to Germany pulling out, collapsing the project altogether.

These scenarios aren't uniformly bearish for the euro over the long haul, though the uncertainty is likely to weigh on the euro's value over the next year. Analysts at Bank of America, for instance, expect the euro to drop to $1.28 by year-end from a recent $1.36, in part because international reserve managers will slow their accumulation of euros.

Under one scenario, Marsh said, the euro could actually re-emerge after a few years of internal strife as a sounder currency. It would be the product of a union of Germany, Europe's biggest economy, and a few like-minded, hard-currency neighbors -- essentially recreating the Deutsche mark before it was subsumed into the euro.

This would be ironic, Marsh said, because "the whole point of European monetary union was to get away from German control."

Any death and rebirth of the euro is years away, however. In the meantime, China and other trade partners will presumably continue to stockpile dollars. This may make the search for an alternative global reserve currency even more frantic -- though likely no more fruitful.

"While prospects for the dollar may not be as bright as they once were, the outlook for its main rivals appears little better," Benjamin Cohen, a professor at the University of California at Santa Barbara, wrote last year in the IMF's Finance and Development magazine. "The scope of any turn away from the dollar is sure to be limited by the lack of a clearly attractive alternative." ![]()

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |