Search News

NEW YORK (CNNMoney.com) -- Palm's future already looked bleak. But after reporting worse than expected results for the third quarter Thursday, some analysts think the company's stock is now essentially worthless.

Shares of Palm (PALM) plunged 19% to $4.59 a share early Friday, a new 52-week low. Investors are becoming increasingly pessimistic about the company's future and several analysts downgraded their positions on the stock to "sell." Two analysts even lowered their price targets to $0.

|

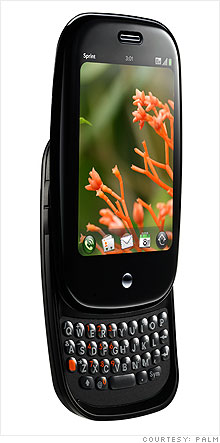

| Palm's Pre smartphone has failed to live up to expectations. Some analysts question how much longer the company can survive. |

In its quarterly earnings report Thursday, Palm posted a loss of 61 cents per share, substantially missing the 43-cent loss expected by analysts.

While the company touted its high volume of shipments, analysts are worried that major carriers such as Verizon (VZ, Fortune 500) and Sprint (S, Fortune 500) just haven't been able to get Palm's phones off their shelves.

Morgan Joseph & Co. analyst Ilya Grozovsky, one of the two analysts to cut its price target on Palm shares to $0, said "Palm is essentially an accelerating death spiral."

"They have had a tremendous problem selling their devices even at carriers like Verizon with 80 million subscribers," he added.

Grozovsky said Palm has attributed its sales slump to salespeople at the wireless carriers not being well enough versed about the potential benefits of new Palm phones such as the Pre and Pixi. So the company is boosting its marketing and re-training sales representatives.

Grozovsky isn't buying this argument though. "They keep saying, 'we need to market, market, market,' because in their mind it's a marketing problem," he said. "But it's not about the trainees and the sales people, it's just too competitive of a space right now for Palm to make any difference."

Palm has struggled to make a dent in the smartphone market. Apple's (AAPL, Fortune 500) iPhone and Research in Motion's (RIMM) BlackBerry are far more popular. Competitors Nokia (NOK) and Motorola (MOT, Fortune 500) have also had more success in the market.

In an attempt to reassure investors worried about the company's financial situation, Palm announced in February that it had $500 million in cash on hand. But analysts expect this buffer to soon be lost given the pace at which the company is burning its money as its attempts to pick up flagging sales.

Canaccord Adams analyst Peter Misek who also lowered Palm's price target to $0 Friday, wrote in a report that "Palm's troubles will only accelerate as carriers and suppliers increasingly question the company's solvency and withdraw their support."

Misek added that he thinks Palm's current cash level can only keep the company afloat for about another 12 months.

Palm was not immediately available for comment about the analysts' downgrades and questions about its cash position. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |