Search News

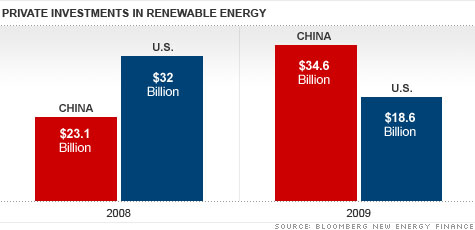

NEW YORK (CNNMoney.com) -- China overtook the United States in renewable energy investments for the first time ever in 2009, attracting nearly twice as many dollars and becoming the world's largest market for clean energy projects.

Renewable energy investments in China - mostly wind farms - totaled $34.6 billion in 2009, according to report released Thursday by the Pew Charitable Trusts and Bloomberg New Energy Finance. In the United States, $18.6 billion was spent.

The report's authors stressed it was the stable, long-term policies put forth by the Chinese government and easier access to credit that attracted the money, and said the numbers do not bode well for America.

"The United States' competitive position is at risk in the emerging clean energy economy," Phyllis Cuttino, director of the Pew Environment Group's Global Warming Campaign, said in a statement.

The report noted that over 700,000 clean energy jobs have been created in the Untied States since 1998, and with so much money being invested in the alternative energy market, this was likely just the beginning.

But with the U.S. losing its dominance in renewable energy, future jobs could be on the line.

Cuttino urged U.S. lawmakers to put a price on carbon dioxide, the main greenhouse gas emitted from burning fossil fuels. A price on carbon would make fossil fuels more expensive and renewables more competitive. She also said the country needs to mandate that utilities buy a certain percent of their power from renewable sources, and create stable, long-term subsidies for renewable energy.

China uses huge amounts of coal to generate electricity and has famously resisted putting a price on carbon dioxide. But the country does have an aggressive mandate that its utilities use more renewable energy.

There are several bills in Congress that would do what Cuttino is seeking but they face considerable resistance from lawmakers and the general public. Opponents either fear the measures would be too costly to the economy, don't believe renewable energy is ready for prime time, or don't think global warming is a major problem.

The investment tallies for China and the United States include all private investments in renewable energy projects, as well as money renewable energy firms raised in stock market offerings, venture capital and private equity deals. They do not include government grants or corporate R&D, which in the United States totaled another $7 billion. How much China spent on government support and corporate R&D was not immediately available.

Worldwide the report said $162 billion was spent on renewable energy, down just 6.6% from the year before. That compares to a 19% drop in investment in the oil and gas industry, according to the report.

In 2010, Bloomberg New Energy Finance is expecting a 25% increase in renewable energy investments to $200 billion.

Asia, with economies that were less severely hit by the recession and easier access to money, saw a 37% increase in investments in 2009. In Europe and America's harder hit economies and tighter capital markets, investments dropped 16% and 33% respectively.

In relation to the size of its economy, Spain saw the largest investment, 0.71% of its gross domestic product went into clean energy. Spain was followed by the United Kingdom, China and Brazil. The United States ranked 11th.

Most of the money spent on renewable energy is in the form of power projects, wind farms, solar arrays or other things that actually produce electricity. Only a small part is spent on R&D or capitalizing start-up companies.

Yet when it comes to innovation, the United States is still the world's leader. The country attracted 60% of all venture capital money spent on renewable energy worldwide. Venture capital generally goes to start-up firms that hold the most promise for future technologies.

"We're very good at creating companies," John Woolard, chief executive at solar power firm BrightSource Energy, said on a conference call discussing the report. "We're not doing a very good job creating markets." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |