Search News

NEW YORK (CNNMoney.com) -- Oil prices slipped Wednesday as a jump in crude oil supplies dimmed hopes that the economic recovery will spur energy demand.

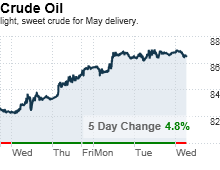

What prices are doing: Crude oil for May delivery fell 96 cents to settle at $85.88 a barrel. This marked the first decline in the past seven trading sessions.

Prices are still about 70% higher than this time last year and hovering near their highest point since Oct. 9, 2008, when crude settled at $86.59.

What's moving the market: Prices fell as investors responded to inventory reports showing mixed results.

The Energy Information Administration on Wednesday said that U.S. commercial crude inventories increased by 2.0 million barrels for the week ended April 2. Gasoline inventories fell by 2.5 million barrels and distillates, which include heating oil and diesel, rose by 1.1 million barrels.

A separate report from The American Petroleum Institute on Tuesday said crude oil supplies rose about 1.1 million barrels. Gasoline inventories fell by 2.9 million barrels, while distillates climbed 723,000 barrels, according to that survey.

Crude inventories were expected to rise by 1.5 million barrels, according to research firm Platts. Gasoline stockpiles were expected to drop by 1.0 million barrels, while supplies of distillates were seen dipping 1.5 million barrels.

What analysts are saying: "The inventory numbers came out as forecast and that dried up buying," said Dan Flynn, an energy trader for PFG Best.

Crude and gasoline inventories are higher than the historical average for this time of year, according to the EIA's report, indicating a growing gap between supply and demand.

But crude prices have risen sharply over the past few trading sessions, despite a stronger dollar, as traders responded to a spate of positive economic news both in the United States and Britain last week.

A rising dollar typically weighs on crude, which is priced in the U.S. currency, since it makes it more expensive for foreign investors. This in turn tends to push demand and prices down.

Flynn says some normalcy returned to the markets on Wednesday after the EIA's inventory report showed a bigger-than-expected buildup in crude supply last week.

"Some of the bulls [in the oil markets] lightened their positions due to the weaker stock market and the strength in the dollar today," he said.

Looking ahead: Traders will keep a close watch on Thursday's initial jobless claims data and other economic indicators.

Even with Wednesday's selloff, many analysts are saying that prices are too high, and could dip further if any new economic data falls short of expectations. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |