Search News

(Fortune) -- Jamie Dimon could be the most dangerous person in America. It's not that he is incompetent and likely to lead his bank quickly onto the rocks. On the contrary, Mr. Dimon threatens our economic and political system precisely because he is so good at his job, and because he is determined to translate his recent success into making his bank even bigger.

Dimon fully understands -- although he can't concede in public -- the private advantages (i.e., to him and his colleagues) of a big bank getting bigger. Being too big to fail -- and having cheaper access to funding as a result -- may seem unfair, unreasonable, and dangerous to you and me. But to Jamie Dimon, it's a business model -- and he is only doing his job, which is to make money for his shareholders (and for himself and his colleagues).

|

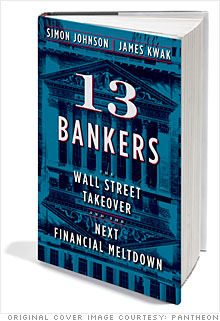

| 13 Bankers: The Wall Street Takeover and the Next Financial Meltdown by Simon Johnson & James Kwak; Pantheon; 320 pages |

Dimon represents the heavy political firepower and intellectual heft of the banking system. He runs some of the most effective -- and toughest -- lobbyists on Capitol Hill. He has the very best relationships with Treasury and the White House. And he is determined to scale up.

The only problem he faces is that there is no case at all for banking of the size and form he proposes. Consider the logic he presents on p. 36 of his recent letter to shareholders.

He starts with a reasonable point: Large global nonfinancial companies are an integral and sensible part of the American economic landscape. But then he adds three more steps:

1. Big companies require big banks

Big companies need big banks, operating across borders, with large balance sheets and the ability to execute a wide variety of transactions. This is simply not true -- if we are discussing banking at the current and future proposed scale of J.P. Morgan Chase (JPM, Fortune 500). We go through this in detail in 13 Bankers -- in fact, refuting this point in detail, with all the evidence on the table, was a major motivation for writing the book. There is simply no evidence -- and I mean absolutely none -- that society gains from banks having a balance sheet larger than $100 billion. (J.P. Morgan Chase is roughly a $2 trillion bank, on its way to $3 trillion.)

2. America's banking system lacks concentration

The U.S. banking system is not particularly concentrated relative to other OECD countries. This is true -- although the degree of concentration in the U.S. has increased dramatically over the past 15 years (again, details in 13 Bankers) and in key products, such as credit cards and mortgages, it is now high. But in any case, the comparison with other countries doesn't help Mr. Dimon at all -- because most other countries are struggling with the consequences of banks that became too large relative to their economies (e.g., in Europe; see Ireland as just one illustrative example).

3. Our neighbor to the north's banking system works just fine

Canada did fine during 2008-09 despite having a relatively concentrated financial system. Mr. Dimon would obviously like to move in the Canadian direction -- and top people in the White House are also very much tempted. This is frightening. Not only does it represent a complete misunderstanding of the government guarantees behind banking in Canada (which we have clarified here recently), but this proposal -- at its heart -- would allow, in the U.S. context, even more complete state capture than what we have observed under the stewardship of Hank Paulson and Tim Geithner. Place this question in the context of American history (as we do in Chapter 1 of 13 Bankers): If the U.S. had just five banks left standing, would their political power and ideological sway be greater or less than it is today?

For a long time, our leading bankers hid behind their lobbyists and political friends. It is most encouraging to see Mr. Dimon come out from behind those layers of protection, to engage in the intellectual fray.

It is entirely appropriate -- and most welcome -- to see him make the strongest case possible for keeping banks at their current size and, in fact, for making them bigger. We should encourage such engagement in public discourse, but we should also examine carefully the substance of his arguments.

Theodore Roosevelt carefully weighed the views of J.P. Morgan and other leading financiers in the early 20th century -- when they pushed back against his attempts to rein in their massive railroad and industrial trusts. Roosevelt was not at that time against big business per se, but he insisted that big was not necessarily beautiful and that we also need to weigh the negative social impact of monopoly power in all its economic and political forms.

If we don't find our way to a modern version of Teddy Roosevelt, Jamie Dimon -- and his successors -- will lead us into great harm. It's true that, after another crash or in the midst of a Second Great Depression, we can reasonably hope to find another Roosevelt -- FDR -- approach. But why should we wait when such a disaster is completely preventable?

Simon Johnson is co-author of 13 Bankers: The Wall Street Takeover and The Next Financial Meltdown (Pantheon, 2010) ![]()

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |