Search News

NEW YORK (CNNMoney.com) -- Goldman Sachs executives endured a barrage of questions from the investment community and reporters Tuesday for its role in creating a complex mortgage security which has since prompted federal fraud charges against the company.

Even as Wall Street's top investment bank reported a first-quarter profit of $3.5 billion, the results did little to alleviate the intense scrutiny the firm has been under since the Securities and Exchange Commission charged the firm with defrauding investors last Friday.

|

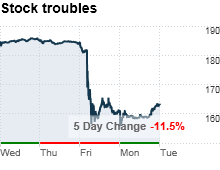

| Goldman Sachs shares have struggled to recover in the wake of the SEC's fraud charges against the financial giant. |

Last week, the agency filed a civil suit against Goldman, alleging that the New York City-based company allowed hedge fund Paulson & Co., who made billions of dollars betting against the U.S. mortgage market, to help select securities in a so-called collateralized debt obligation, or CDO.

The SEC also charged Goldman with failing to tell investors that Paulson was betting that the value of the investment would decline. Investors in the security ultimately lost $1 billion, according to the SEC.

Goldman Sachs executives rejected many of the SEC's claims Tuesday, maintaining that Paulson never had a hand in selecting the securities and that the other investors in the deal were never deceived in any way.

"We would never intentionally mislead anyone," said Greg Palm, Goldman's co-general counsel during a conference call with investors Tuesday morning.

Palm, joined by Goldman's chief financial officer David Viniar, maintained that the two lone investors in the fund - German bank IKB and bond insurer ACA Capital - did their own extensive research.

Goldman also deflected suggestions that it profited from the failure of the deal. It said the firm had no "economic motivation" for its investors to lose money, adding that it invested alongside the pair, losing over $100 million as a result of the transaction.

The two executives also downplayed speculation that it could be facing criminal charges from the federal government, namely the Justice Department. Palm said Goldman has had no "conversations" beyond the SEC's civil charges.

So far, the company has made it clear it has every intention of fighting the government's charges. In the wake of Friday's announcement, Goldman called the charges "unfounded", adding that they planned to "vigorously contest" them.

When pressed on the issue by an analyst Tuesday however, Viniar didn't seem to rule out the possibility of a settlement with the SEC.

"We don't know how this case will unfold at this point," he said.

Goldman executives hinted Tuesday that they tried to resolve the matter with regulators when the company was first alerted to the probe in August of 2008. But after providing regulators with extensive details about their mortgage documents, executives said they were caught off-guard by Friday's announcement.

Some analysts and journalists, however, questioned why the firm kept the firm secret from its shareholders.

"Given the fact we thought we had a good case, we thought we didn't have any need to disclose it," said Palm in a call with reporters.

Conspicuously absent from the two conference calls was Goldman Sachs CEO Lloyd Blankfein, who has been under intense scrutiny in recent months on a number of issues -- including the firm's employee bonus program.

Blankfein acknowledged the suit in a statement, but did little more than thank its clients, shareholders and employees for standing with the firm.

"In light of recent events involving the firm, we appreciate the support of our clients and shareholders, and the dedication and commitment of our people," Blankfein said in the statement.

Shares of Goldman Sachs (GS, Fortune 500) fell over 1% in midday trading Tuesday as the market appeared to remain a bit nervous about the suit.

Still, investors in the firm, who watched Goldman shares plummet 13% Friday in the wake of the SEC announcement, had some reason to be encouraged Tuesday.

Revenues in the company's investment banking business jumped from a year ago, as strong stock and debt activity offset weakened deal-making activity.

Trading volume also rose during the quarter. And even as the company added to its compensation pool, the source of the firm's famously large bonuses, it did little to take the shine off Goldman's overall profits, which rose 91% from last year's earnings of $1.8 billion.

On a per share basis, Goldman earned $5.59 per share in the latest quarter, on revenue of $12.8 billion. Consensus estimates were for the company to record a profit of $4.01 per share and revenues of $11 billion, according to Thomson Reuters.

"Our performance in the first quarter reflects more signs of growth across the economy and the strength of our client franchise," Blankfein said in the statement.

Goldman is the latest big bank to report better-than-expected earnings for the first quarter, joining rivals Citigroup (C, Fortune 500), Bank of America (BAC, Fortune 500) and JPMorgan Chase (JPM, Fortune 500). Those three banks also delivered healthy results thanks largely to increased trading revenue.

Morgan Stanley (MS, Fortune 500) and Wells Fargo (WFC, Fortune 500) are due to report their latest results on Wednesday morning. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |