Search News

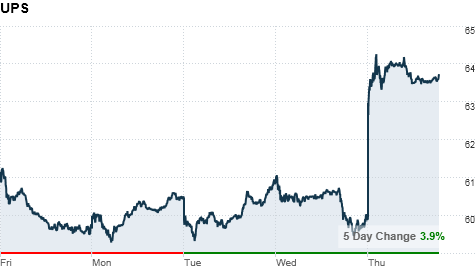

NEW YORK (CNNMoney.com) -- Shares of UPS surged Thursday after the world's largest delivery company reported sales and earnings that beat analysts' expectations and raised its outlook for the rest of the year.

UPS (UPS, Fortune 500) was up $3.60 a share, or 6%, to $63.61 in afternoon trading.

The rally came after UPS said second-quarter earnings surged 90% on strong sales in the United States and abroad. Big Brown also said it expects earnings to grow this year despite the "slow pace of the U.S. recovery."

Investors cheered the results because UPS, which delivers consumer products around the world, is seen as a proxy for overall economic activity. Stocks were up more than 2% with about two hours left in the session.

"The market is adjusting to the idea that companies can still perform in a slow growth environment," said James Ragan, an analyst who covers UPS at Crowell, Weedon & Co.

While the results benefited from an easy comparison to last year, Ragan said investors were encouraged to see that sales at UPS continued to grow despite signs the economic recovery has hit a soft patch.

"I think people are feeling today that there's still room for revenue growth," he said.

UPS said revenue in the quarter jumped nearly 13% to $12.2 billion.

The Atlanta-based company said it earned $845 million, or 84 cents a share, in the second quarter. That's up from $445 million, or 44 cents a share, a year earlier.

Analysts were expecting earnings of 77 cents per share, according to consensus estimates from Thomson Financial.

Looking ahead, UPS said it expects 2010 earnings to be in a range of $3.35 to $3.45 a share. Analysts had been expecting full-year earnings of $3.27 a share. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |