FORTUNE -- There's real money in the world, then there's funny money -- stuff that looks real, but isn't.

Today, let's talk about one of the world's biggest piles of funny money -- the $2.54 trillion Social Security trust fund. The trust fund matters now, because Social Security revealed last week that it plans to tap it for $41 billion this year, and will begin tapping it on a regular basis in less than five years.

This year's cash deficit, the first since the early 1980s and the biggest ever, means the Treasury will have to borrow money to redeem some of the trust fund's Treasury securities. Even at a time when Uncle Sam is borrowing $1.5 trillion a year to keep his checks from bouncing, $41 billion is real money.

Here's why the trust fund has no economic value. Let's say I begin taking Social Security when I hit the full retirement age of 66 later this year. Because its tax revenues are below its expenses, Social Security would have to cash in about $3,400 of its trust fund Treasury securities each month to get the money to pay my wife and me. The Treasury, in turn, would have to borrow $3,400 from investors to get the money to pay Social Security. The bottom line is that the government has to borrow from investors to pay me, regardless of how big the trust fund is.

It's not surprising that Social Security is now running a negative cash flow -- I predicted a year ago it was likely to happen this year, and wrote in February that it had happened.

Democrats, for the most part, say everything's fine because the trust fund has a fat balance. Republicans, who were happy to have Social Security taxes subsidize tax cuts for 25 years, have suddenly developed holier-than-thou fiscal rectitude. They're both wrong -- the Democrats financially, the Republicans morally.

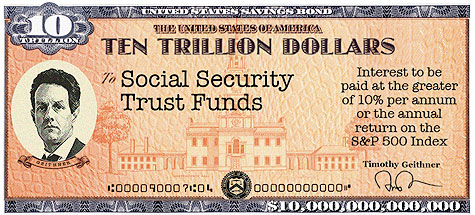

Let me show you in two different ways how useless the trust fund is. The first is a quote from the introduction to the 2009 Social Security trustees report, the second is the graphic by my Fortune colleague Robert Dominguez that accompanies this article.

The 2009 quote, spotted by Allen Smith, economics professor emeritus at Eastern Illinois University, and author of The Big Lie: How Our Government Hoodwinked the Public, Emptied the S.S. Trust Fund, and caused The Great Economic Collapse, is telling.

It says that, "Neither the redemption of trust fund bonds, nor interest paid on those bonds, provides any new net income to the Treasury, which must finance redemptions and interest payments through some combination of increased taxation, reductions in other government spending, or additional borrowing from the public."

In other words, the trust fund is of no economic value.

This sentence wasn't in the 2010 introduction, released last week. Treasury says it still stands by it, but that the Social Security trustees decided not to include it this year because it merely reiterates the obvious.

Now, to the "Geithner bond," which shows how easy (and useless) it would be for Treasury to stick as many bonds as needed into the trust fund, and declare Social Security to be sound forever.

You know, of course, why this wouldn't work -- at least, I hope you know. It's because the U.S. government ultimately has to pay its bills with cash, not with its own IOUs. In the long run, you need cash -- real money -- not funny money. Other than being a send-up, this hypothetical Geithner trust fund bond is no different than the Treasury bonds the trust fund owns, except that it carries a higher interest rate.

There are ways, even at this late hour, to begin turning the trust fund from funny money into real money without unduly stressing the government's finances. (I've discussed them before, and will do so again, but not today.) Given that taxpayers are bailing out the most imprudent companies and people in the country, we damn well should bail out Social Security, the mainstay of low- and middle-income people.

But let's not kid ourselves that a fat trust fund is the solution. When Social Security's cash deficits begin running more than $100 billion a year within a decade, it's going to take a lot of money to keep the checks coming. And it sure won't be funny. ![]()

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |