Search News

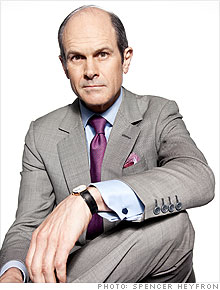

FORTUNE -- Dick Kelly wishes he knew what his industry should do. "If we had a national policy and knew what the rules were, we could take action," says Kelly, CEO of Xcel Energy and chairman of the Edison Electric Institute, the association of shareholder-owned electric utilities. But Kelly's industry knows only that momentous changes in the federal laws governing it are probably on the way; what those changes might be, and when they might happen, managers have no idea. So they "are holding up decisions," Kelly says, on multibillion-dollar investments to convert old coal-fired power plants to natural gas. "Is there going to be a price on carbon?" he asks. "Will there be a timeline? Will we have to use a certain percentage of renewables?" No one knows, so nothing is happening.

Multiply the utilities' experience across the economy, and we begin to see an important reason why growth is getting slower rather than faster as the recovery creeps along. When people aren't sure what's going to happen, they freeze. We all know it, and if you require validation of your instincts, check the scientific literature on "uncertainty paralysis." When we're unsure, we turn especially cautious.

Life is inherently uncertain, of course, but this is different. As I travel around the country, businesspeople tell me they've rarely felt so unsure of what the laws and rules governing their business will be. Like Kelly, they sense major changes ahead -- but what? So instead of investing and hiring as usual in a recovery, U.S. companies are sitting on more cash than ever. We shouldn't be surprised. It has always been true that the more activist the administration in Washington, the more uncertainty it spawns. The reasons are several.

Sweeping new laws -- like the 2,400-page health care law and the 2,300-page Dodd-Frank financial services law -- create winners and losers, but the horsetrading continues almost until the President's pen signs the bill. Did you know that Dodd-Frank exempts car dealers from the oversight of the new Consumer Financial Protection Bureau? Such oddities are legion, but in major legislation still to come, such as an energy bill, no one knows what they'll be.

Once these mammoth laws are enacted, government agencies must write new rules to implement them. For example, the Dodd-Frank law requires 243 new rules, by the count of the Davis Polk & Wardwell law firm, and no one yet knows what they'll require.

It takes a long time to figure out what the new rules really mean, especially at 2,000 pages. When I asked AT&T (T, Fortune 500) chief Randall Stephenson whether the new health care law might cause him to drop medical coverage for his employees, he did not say anything to reassure workers. "We don't know exactly what we've got here yet," he said. "But something will change." McDonald's (MCD, Fortune 500) recently said it might drop medical coverage for 30,000 employees because of a rule buried in the new law. Such surprises are only beginning.

These historic new laws bestow significant new powers on administrators, who are not elected and are highly unpredictable. For example, the new Consumer Financial Protection Bureau has been granted extremely broad powers; its director (not yet nominated) is apparently "beyond the control of the President, the Fed, and the Congress," says Investment News magazine, citing the new law. What new rules will it promulgate in its first five years?

Uncertainty is a Republican talking point in the midterm elections, so Democrats disparage it, maybe leaving ordinary citizens to dismiss the debate as partisan sniping. That would be a shame. The businesspeople I talk to aren't libertarians who want a minimalist government. They're pragmatic managers who want to make an honest buck. As Dick Kelly says, "If they explain the rules, we'll figure it out. We've always figured it out, and we'll figure it out again." More than at any time in many years, businesspeople just don't know what the rules are. They're frozen. Writ small, that's a frustration. Writ large, it's an economy that can't get going. ![]()

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |