Search News

NEW YORK (CNNMoney.com) -- Treasury prices continued to rise Thursday, after the Fed's launch of a $600 billion bond-buying spree and a weak labor report boosted the appeal of government debt.

Anticipation of a second round of asset purchases from the Fed has lent support to the bond market recently, as traders have tried to get ahead of the government's big buy.

Now, after the Fed laid out its plan Wednesday, buyers who were previously sitting on the fence, are jumping in to buy bonds and front-run the government's purchases, said Michael Cheah, a bond fund manager at SunAmerica.

Bond traders are trying to get ahead of the Fed's $600 billion in purchases, by getting into the market at current prices and yields. The large bond purchases by the government are meant to drive Treasury prices higher and yields lower.

"If you know the Fed is going to be buying, you can't be short the market," said Kim Rupert, fixed-income analyst at Action Economics. "There's a big player out there who's going to be buying. You cannot go against what you know is going to happen."

The Fed wants to lower Treasury yields and push interest rates lower -- making it cheaper for businesses and consumers to borrow money. The Fed hopes the move, known as quantitative easing, will encourage spending and jump start the recovery.

Meanwhile, bond traders also looked to a weekly jobs report that came in weaker-than-expected Thursday. Because the report showed more Americans filed for first-time unemployment claims than analysts had expected, it was seen as a discouraging sign for the job market and the economy as a whole.

Downbeat economic news often increases the appeal of Treasuries, because they're backed by the U.S. government and considered a low risk asset in times of uncertainty.

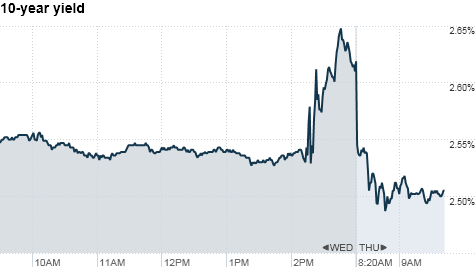

What yields are doing: Prices rose as yields fell Thursday. The yield on the benchmark 10-year note fell to 2.48%, down from 2.62% late Wednesday.

The yield on the 30-year bond fell to 4.04%, from 4.06%. Yields on the 2-year note fell to 0.34%, and the 5-year note slipped to 1.03%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |