Search News

Click chart for prices and rates.

Click chart for prices and rates.

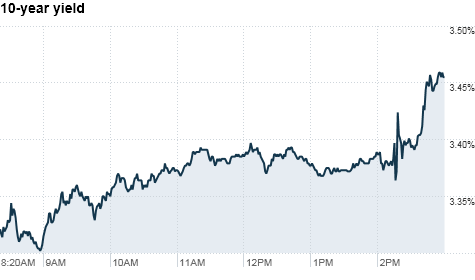

NEW YORK (CNNMoney.com) -- Treasuries tumbled Tuesday, sending yields to seven-month highs, after the Federal Reserve kept its bond-buying program intact and said the economy is still recovering.

In the policy statement following its last meeting of the year, the central bank left its key interest rate near zero and said that while it expects a gradual recovery, progress has been "disappointingly slow."

It also said it is moving ahead with its plan to inject $600 billion into the economy through the purchase of long-term Treasuries, its second round of quantitative easing which has been referred to as QE2.

While most of what the Fed announced was widely anticipated, some bond traders had expected the central bank to unveil even more measures to help the economy.

"Some people had built up hope that there would be an increase in government bond-purchasing, but that was not announced today," said Anthony Valeri, an fixed income investment strategist at LPL Financial. "From [the Fed's] perspective, it's too early to increase the dose because it's still too early to evaluate the effectiveness of [QE2]."

That disappointment -- along with gains in the stock market -- added pressure to an early sell-off in the bond market. Following the Fed's statement, yields on the 10-year note and 30-year bond surged to the highest levels since May.

The yield on the 10-year benchmark note closed at 3.44%, up from 3.28% late Monday.

Meanwhile, the yield on the 30-year bond jumped to 4.5% from 4.4%. The 2-year yield rose to 0.64% from 0.55% and the 5-year yield increased to 2.03% from 1.89%.

While Treasuries staged a slight recovery Monday, prices have been in a downward spiral (with yields rising) as economic data improves. And a better-than-expected report on retail sales Tuesday fueled that optimism early in the session.

Retail sales rose 0.8% in November, according to the Department of Commerce. That beat the 0.5% increase economists had forecast. Excluding auto sales, retail sales jumped 1.2%, much higher than the expected 0.6% rise.

Stocks gained on the news, as investors took the report as a sign of rebounding consumer spending.

But many bond traders are staying on the sidelines until they get more compelling news that a recovery is gaining momentum, said Kevin Giddis, managing director of fixed income at Morgan Keegan.

"Investors remain cautious of what appears to be an economic turnaround of sorts," he said in a note to investors. "This 'football' has been pulled away before and most still remember the headache associated with optimism. I certainly do!" ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |