Search News

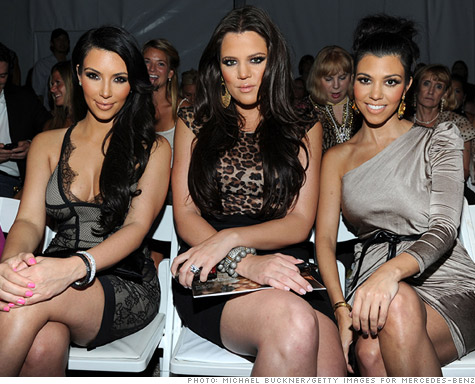

Kim Kardashian, left, with her sisters Kourtney and Khloe.

Kim Kardashian, left, with her sisters Kourtney and Khloe.

NEW YORK (CNNMoney) -- The Kardashian sisters are being sued for more than $75 million over pulling the plug on their pre-paid debit card venture -- and for expenses related to a lavish launch party.

Just over a month ago, the reality TV stars terminated their endorsement of the Kardashian Kard amid criticism of predatory fees, with the Kardashian family's attorney claiming the "negative spotlight ... threatens everything for which they have worked."

But Kim, Khloe and Kourtney are back in the spotlight again, with lawsuit accusing them of breaching their contract. The Kardashians' mother, Kris Kardashian Jenner, along with the family's company, Dash Dolls LLC, were also named in the lawsuit.

The $75 million represents the losses the Revenue Resource Group said it expects from the breach of contract.

"It's $75 million and nothing less than $75 million," said Nathan Miller, an attorney at law firm Miller & Ayala representing Revenue Resource Group, which worked with MasterCard and the Kardashians to create their prepaid card. "With the Kardashians' star power, the amount of cards they would have sold would have been off the chart."

In addition, the company wants to be reimbursed $500,000 for out-of-pocket expenses, including the $65,000 the company said it spent throwing a launch party in New York City for the card.

For the launch party, Miller said Revenue Resource Group paid more than $5,000 for Khloe to fly first-class to the party and $7,000 for someone to do the sisters' hair and makeup -- negotiated down after Kim originally asked her hair stylist to be flown to the party for a total price tag of $12,000.

The company also paid $1,900 for an Escalade to drive them around, $6,360 for bottle service at the launch party, and covered the cost of their hotel rooms. The total cost of the party added up to more than $65,000, Miller said.

While the sisters were required to be at the party promoting the new card for at least three hours, Miller said they left the party after 55 minutes and their mother had to be called in order to get them to come back. Once they returned, "they sat in a corner and text messaged on their iPhones all night," Miller said.

CNNMoney called the Kardashians' attorney, Dennis Roach, about the lawsuit and other claims, but he would not comment.

Based on the initial success of the card and the success of other comparable cards, like Russell Simmon's Rush Card, the Revenue Resource Group expected to make $75 million from the card during the two-year contract, and the starlets were likely to have made a combined amount of between $40 and $60 million, said Miller.

"Financially it was a huge mistake to cancel it," he said. "[The Kardashians] didn't take the time to learn about the account -- the negative publicity comes out and says the fees are too high, and instead of educating the public about the good things about the card, they said, 'Nope, we're out.'"

Regular bank debit cards are typically free to purchase and come with monthly maintenance fees averaging about $13. A 12-month Kardashian Kard cost $99.95 to own, including a $9.95 to buy the card and 12 monthly fees of $7.95.

On top of the initial fees, it cost Kardashian Kard users $1 every time they added money to their card, and it cost $1.50 to speak with a live operator. If they wanted to pay their bills automatically using the card, they were charged $2 per transaction.

In exchange, consumers could load their card with money to make payments online, over the phone or in stores without racking up credit card debt or overspending their checking accounts.

Connecticut Attorney General Richard Blumenthal was one of the card's biggest critics. Before the Kardashians cancelled the card, Blumenthal wrote a letter to the card's issuer questioning the legality of the card's "pernicious and predatory fees" and saying the card was "particularly troubling because of its high fees combined with its appeal to financially unsophisticated young adult Kardashian fans."

But Miller said his accusations were "ignorant," arguing that prepaid cards are great options for unbanked consumers.

The notion of debt-free spending has caused prepaid cards to shoot up in popularity, becoming increasingly attractive among consumers who don't qualify for credit cards, are fed up with skyrocketing interest rates or are young and just entering the world of plastic.

"There are a lot of people out there who cannot qualify for a credit card," he said. "A lot of people in poor economic conditions need this kind of card and are excited about it." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |