Search News

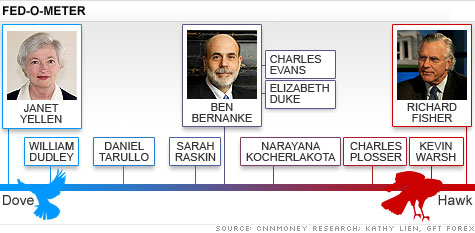

The Fed's newest voting roster includes a more even balance of inflation doves versus hawks, but all were in agreement at the first meeting of the year.

The Fed's newest voting roster includes a more even balance of inflation doves versus hawks, but all were in agreement at the first meeting of the year.

NEW YORK (CNNMoney) -- Looks like the new year brought no change for the Federal Reserve.

In its first meeting of 2011, the central bank said it remains cautious about the economic recovery. It decided to leave interest rates unchanged near historic lows and continue with its $600 billion bond buying program to stimulate the economy.

"This is the same language," said economist Robert Brusca with FAO Economics. "The language of disappointment from the Fed."

The anticlimactic decision was unanimous among all 11 members of the Fed's voting committee, including the four newest voters.

It's no shocker that the Fed would stand pat on the fed funds rate, which has remained at historic lows near zero since 2008.

When the central bank first announced its bond buying policy, known as quantitative easing last November, the Fed promised to reevaluate as necessary.

And with a few more hawkish voting members rotating in this year, some had questioned whether the Fed would proceed full speed ahead.

Several of the new voting members are considered inflation hawks, and have publicly spoken out against quantitative easing, fearing that the flood of easy money could lead to rising inflation. Among them, Philadelphia Fed President Charles Plosser and Dallas Fed President Richard Fisher are the most vocal.

Prior to Wednesday's meeting, Fed watchers speculated as to whether either Fisher or Plosser would take a formal stand, officially dissenting at the meeting.

But neither one did.

"It's one thing to be vocal, it's a completely different thing to cast a vote against the chairman," Brusca said.

Perhaps the most vocal inflation hawks decided it wasn't appropriate to dissent at the first meeting of the year.

"You could lose your credibility and become a clank. Or, you can wait until you really have something to dissent over," Brusca said.

On last year's voting roster, only one member -- Kansas City Fed President Thomas Hoenig -- dissented officially, and did so at all eight meetings of the year, speaking against the Fed's policy of keeping interest rates low for an "extended period."

In moving ahead with quantitative easing, the Fed is attempting to meet both its job responsibilities: to keep prices stable and maximize employment.

While the object of the policy is to get more money into the economy and stimulate growth to create jobs, it comes at the risk of higher prices. But with inflation pressures remaining low, the Fed sees little danger in pursuing more monetary stimulus.

"Currently, the unemployment rate is elevated, and measures of underlying inflation are somewhat low," the Fed said in its official statement.

Since the recession, the central bank has struggled, however, to significantly bring down the unemployment rate, which currently sits at 9.4%.

Some critics -- including some Fed members -- have recently warned that accommodative monetary policy could devalue the dollar and fuel inflation at a time when the economy is already improving.

The Federal Reserve's voting body is currently made up of eleven members: Chairman Ben Bernanke, five Fed governors, the president of the New York branch and four regional bank presidents who rotate each year.

One Fed governor position -- which would bring the voting total up to 12 -- remains unfilled. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |