Search News

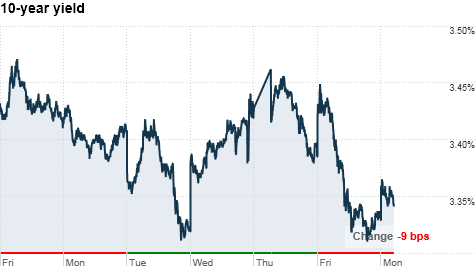

Click the chart for more bonds data.

Click the chart for more bonds data.

NEW YORK (CNNMoney) -- Treasury prices were slightly lower Monday and yields rose as investors took a break from last week's bond-buying frenzy.

The benchmark 10-year note fell, driving its yield up to 3.34%. Prices and yields move in opposite directions.

The 30-year bond's yield rose to 4.55%. Yields on the 2-year note rose to 0.56% and the 5-year note increased to 1.93%.

Traders are closely watching the political uprisings in Egypt and looking ahead to economic data out later this week, said Kim Rupert, a fixed income analyst with Action Economics.

"There are several economic reports and events this week, keeping further buying on the sidelines. The market is taking sort of a wait-and-see mode right now," she said.

If economic data comes in strong this week, that could fuel investors to take on riskier bets like equities, in lieu of bonds.

But heightened political instability in the Middle East could have the opposite effect, Rupert said.

The riots in Egypt initially fueled a flight-to-quality trade last week, sending investors flocking to the safety of U.S. Treasuries. But that trade seemed to die down over the weekend, and "Treasury volume is back to low-volatility blahs," Jim Vogel, head of agency debt research at FTN Financial, said in a note to investors.

"The world's governments don't know quite how to react yet to political events in Egypt, and markets are in the same predicament," he said.

The rest of the week brings several potential market movers:

On Tuesday, the Institute for Supply Management will release its latest reading on the manufacturing industry.

Starting on Wednesday, several reports on the labor market are due, leading up to the grand daddy of them all -- the government's monthly job report on Friday.

And on Thursday, Federal Reserve Chairman Ben Bernanke is scheduled to take reporters' questions in Washington D.C. Bond traders will be listening in, looking for hints about his stance on long-term inflation. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |