Search News

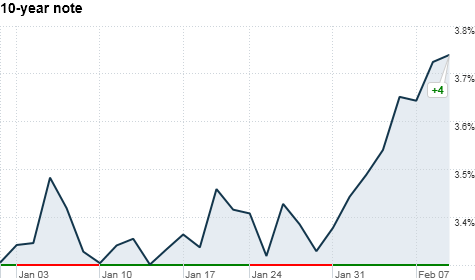

The yield on U.S. 10-year note has risen more than 0.3 percentage points since late January. Click the chart for more data on U.S. treasuries.

The yield on U.S. 10-year note has risen more than 0.3 percentage points since late January. Click the chart for more data on U.S. treasuries.

NEW YORK (CNNMoney) -- Treasury yields continued their general trek higher this week, with the benchmark 10-year hitting its highest level since last April on Tuesday.

Fixed-income investors said this multi-day rise is due in part to expectations of a generally-improving economy and lingering, but more concrete, concerns about inflation.

After hitting a 10-month high on Tuesday of 3.72%, the yield on the benchmark U.S. 10-year note fell to 3.67% on Wednesday following the strong results of the government's 10-year note auction.

Despite the minor pullback, the yield on the 10-year has risen 0.3 percentage points in little more than a week. Before this move, the 10-year note remained mostly in a range between 3.3% and 3.4% since mid-December.

While the recent move in longer-term Treasury rates is noticeable, bond yields have actually been trending higher since November. That may be because the Federal Reserve's $600 billion quantitative easing program is beginning to have its intended effect of providing stimulus to the economy, investors said.

"All of the economic indicators show an improving economy and the possibility of higher inflation" said William Larkin, portfolio manager with Cabot Money Management. "Bond investors are selling into that." (Bond prices and yields move in opposite directions.)

Federal Reserve Chairman Ben Bernanke said on Wednesday he had taken note of the recent rise in bond yields, but said such movements were expected.

"I'm not concerned," Bernanke said, in response to a question from a member of the House Budget Committee. "I think it reflects primarily increasing optimism about the U.S. economy, and it's natural for [Treasuries] to move in that way when investors become more optimistic about growth."

The more traditional government inflation indicators have remained tame for months now -- January's U.S. consumer price index showed a modest 0.8% year-over-year increase in core inflation -- but food and energy prices have risen sharply.

Oil prices are up 8% in the past six months while wheat and corn prices are up 20% and 60% respectively in the same time period.

"The inflation readings that the Fed uses show no concerns about inflation but the market is starting to price in the risk of inflation," said Mike Pond, chief fixed income strategist with Barclays Capital.

Traders said with this momentum, the 10-year note could reach the 4% yield mark. But most consider a pause in the 3.7% to 3.8% range to be more likely.

"If the market becomes more concerned about these long-term budgetary problems and inflation, I don't think a 4% 10-year is out of the question," Pond said.

Also weighing on Treasuries is the $72 billion in long-term bonds the U.S. government is auctioning off this week.

After Tuesday's disappointing 3-year auction, the Treasury Department auctioned off $24 billion in 10-year notes at a yield of 3.67% on Wednesday. The yield was lower than where bonds had been trading earlier in the day, a sign of strong demand.

On Thursday the Treasury will auction off $16 billion in 30-year bonds. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |