Search News

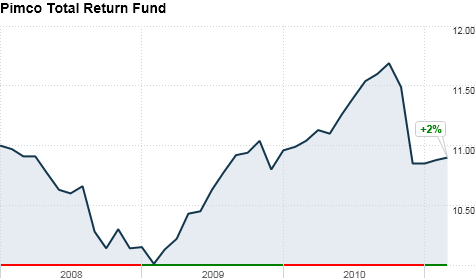

Click the chart for more details about the fund and its performance.

Click the chart for more details about the fund and its performance.

NEW YORK (CNNMoney) -- Pimco's Total Return Fund (PTTRX), the world's biggest bond fund, slashed its exposure to U.S. government debt to zero last month.

It's the second month in a row that well-known fund manager Bill Gross has drastically reduced Pimco's exposure to U.S. government debt.

Gross has been very vocal about his feelings toward U.S. interest rates, saying in January that they were "robbing" investors and that U.S. government debt should be "exorcized" from investors' portfolios.

The Total Return Fund held about 22% of its holdings in U.S. government debt as recently as December, but reduced those holdings to about 12% in January.

Pimco defines U.S. government-related securities as not only U.S. Treasuries but also government agency debt, interest rate swaps, futures and options and FDIC-guaranteed corporate securities.

Gross's comments typically carry considerable influence on investors because his Total Return Fund is by far the world's largest bond fund with more than $240 billion in assets under management. It's also the best-performing bond fund for the last 15 years, according to Morningstar.com.

In his February newsletter, Gross said he believes U.S. Treasuries are trading at a yield of 1.5 percentage points below where they should be historically, making them an unattractive place to invest for the time being. Gross also reiterated that stocks and bonds may struggle this summer when the Federal Reserve ends its second quantitative easing program.

"Yields may have to go higher, maybe even much higher to attract buying interest," Gross wrote.

At the same time that he reduced his exposure to U.S. government debt, Gross vastly increased his cash and cash-equivalent position last month. Cash now makes up 23% of the portfolio compared to the 5% of the portfolio the fund had in January. The fund also increased its holdings of overseas emerging market bonds to 10% of its assets, up from 5%.

The Total Return Fund also reduced its exposure to mortgage-backed securities to 34% of the portfolio, down from 42% of the portfolio in January.

The price on the benchmark U.S. 10-year note rose slightly Thursday, pushing the yield down to 3.44% from yesterday's 3.47%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |