Search News

NEW YORK (CNNMoney) -- The fiscal year is 189 days old, and the federal government is still operating without a long-term spending bill. And now, if lawmakers can't cut a deal, the government will shut down.

Usually, lawmakers make some effort to pass a real, 365-day budget. Not this year.

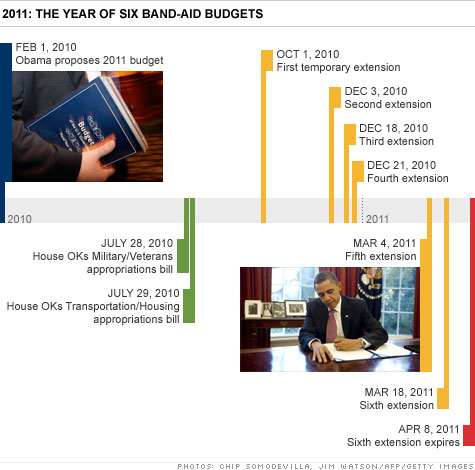

Instead, lawmakers have passed six short-term spending bills. With their Friday deadline bearing down, the two parties remain billions of dollars apart on spending cuts.

"This is just an eyeball-to-eyeball moment where Republicans want to exercise their power," said Julian Zelizer, a professor of history and public affairs at Princeton University. "And Obama is trying to defend his reputation with Democrats."

As even school children know, Congress has the responsibility to appropriate funds for the government to spend. It's right there in Article 1 of the Constitution. But this year -- and let's not mince words -- lawmakers have fallen down on the job.

Of course, short-term spending bills are nothing new. Congress has enacted at least one every year for all but three of the past 30. But six in one year? How did it come to this?

President Obama first proposed a budget for fiscal year 2011 on Feb. 1, 2010. That was 431 days ago.

If the process worked as designed, Congress would have taken a look at the president's suggestions. Lawmakers on the budget committees would have set target spending levels, and appropriations committees would have hammered out spending plans to fit.

The result was supposed to be 12 separate appropriations bills. Congress would have voted on each, and moved them to the president's desk. That's all supposed to happen by Oct. 1, the start of the fiscal year.

Here's what Congress did manage to do: The House produced two of 12 appropriations bills. The Senate has not voted on a single one. Lawmakers couldn't even agree on their own legislative budget.

And those two House votes? They happened way back in July, when Democrats had huge majorities in the House and Senate, with Obama in the White House.

Why Democrats failed to take more action when they had the chance remains somewhat of a mystery. Remember, this is the same Congress that moved heaven and earth to enact landmark health care and Wall Street reform laws.

In the absence of a full-year budget, lawmakers have instead passed six short-term spending bills called "continuing resolutions." Designed to bridge short-term gaps in appropriations, Congress has approved one after another to keep the government running. Average length: 31 days.

The budget punt has implications for effective governance.

Continuing resolutions, with the exception of the two most recent efforts by Congress, freeze spending at the prior year's levels.

That forces federal agencies into a head snapping game of stop-and-go. Hiring is delayed, work is repeated, and agencies struggle to implement new legislation. Uncertainty is king, with agencies left to guess what their funding level for the year might be.

Just ask the Securities and Exchange Commission, which is trying to implement the new Wall Street oversight law with last year's staffing.

Add in the threat of imminent government shutdown coming around, on average, once a month, and it's easy to see why agencies are praying the budget Merry-Go-Round stops soon.

As if to call attention to their own failure, both Republicans and Democrats have spent months issuing high-profile calls for a return to responsible budgeting.

Yet they have made no progress.

The latest stalemate has lawmakers about to plunge into the precipice as they argue over a few billion dollars and a set of contentious political issues -- like abortion -- that have been inserted into the debate.

On Wednesday, lawmakers from both parties met at the White House in the hopes of reaching an agreement. They did not.

What happens next is largely unclear. One scenario is that lawmakers will pass another short-term bill before Friday. There also might be a minor miracle in the form of a six-month spending deal that would cover the rest of the fiscal year.

Or, the government might close its doors. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |