Search News

Click chart for more currency data

Click chart for more currency data

NEW YORK (CNNMoney) -- The fate of the U.S. dollar for the remainder of the year will hinge on the Federal Reserve's actions, as analysts try to look into their central bank crystal ball for clues about the Fed's future monetary plans.

Last week's minutes from the Fed's March 15 meeting revealed central bankers are split over whether there is a need for more stimulus, although Fed chairman Ben Bernanke has not even come close to suggesting anything of the sort.

The Federal Open Market Committee (FOMC) is known for keeping future policy matters close to its chest.

In its statement, the organization simply noted that "a few" FOMC members believe it may be necessary to implement a "less-accommodative" monetary policy. However, "a few others" feel conditions may not warrant a change in the Fed's support efforts until next year.

How's that for clarity? In fairness to the FOMC, the recent spike in inflation is forcing a rethink in how to best manage the economy.

Bernanke has consistently downplayed inflationary fears. In an address last week before the 2011 Financial Markets Conference in Georgia -- the day before the minutes were released -- Bernanke referred to the current inflation levels as "transitory" and almost entirely the result of a "temporary" jump in oil and commodity prices.

When discounting the volatility of food and energy prices from the Consumer Price Index calculation, inflation -- according to Bernanke -- is actually "a bit low".

Families watching their grocery bills climb or shelling out 20% more at the gasoline pumps may take exception with Bernanke's assertion of "low" inflation. The market, however, immediately seized upon the comments as a sign that the Fed remains committed to ending the current round of stimulus spending in June.

Nicknamed "QE2" to describe the Fed's second round of quantitative easing, the stimulus spending plan committed $600 billion for purchasing Treasury securities to boost liquidity.

With less than three months remaining in the program, thoughts turn to whether another round of spending -- a "QE3", if you will -- will be necessary.

Those arguing that no further stimulus is needed point to the slow but steady growth in consumer spending, the significant improvement in corporate balance sheets, and the gains made on the employment front since the Fed increased liquidity.

Certainly we are not out of the woods yet, but there is a growing sense that the nascent recovery is picking up steam. If the Fed agrees with this sentiment it seems likely that the stimulus buck will stop at QE2.

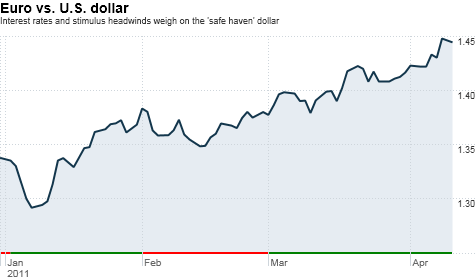

U.S. Interest Rates. Last week, the European Central Bank raised interest rates by 25 basis points to 1.25%. For several days leading up to the announcement, the euro gained on the dollar as the market priced in the anticipated interest increase.

The Bank of England is also under pressure to hike rates as inflation continues to exceed the Bank's 2% target. Canada and Australia, two exporting countries expected to benefit from rising commodity prices for the remainder of the year, will also likely be forced to boost interest rates later in the year.

With the exception of Japan -- still struggling with last month's tragic events -- and the United States, most major economies will probably hike interest rates over the coming months.

Bernanke told the Senate banking committee in early March that the Fed was prepared to maintain the record low rate for an "extended" time. Indeed, the Chairman's latest comments dismissing inflation reaffirms this position and supports the premise that interest rates will remain unchanged until at least the end of the year.

For the dollar, this will have a dampening effect as investors sell U.S. dollars in favor of securities denominated in currencies with greater yields. Global events also impact exchange rates, however -- especially unpredictable "Black Swan" events like the recent problems in the Middle East and Japan.

That unpredictability could keep the U.S. dollar from sliding too far. Even last week's announcement that Portugal is seeking emergency funding sent investors back to the perceived safety of the dollar.

Commentary: Scott Boyd is a currency analyst with Toronto-based foreign exchange trading firm OANDA. He also contributes to OANDA'sMarketPulse FX blog. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |