Search News

NEW YORK (CNNMoney) -- The municipal bond market is finally starting to recover from a severe winter slump, and some experts say the outlook for state and local government debt is sunnier than ever.

Investors dove out of munis late last year after headlines about looming defaults sparked a heavy sell-off, with some $30 billion being pulled out just between Dec. 1, 2010 and March 31 of this year, according to the Investment Company Institute.

Though investors continue to pull money out of the market, redemptions have slowed in recent weeks.

"The fear over a massive wave of impending defaults is overblown and uninformed, but the reality is that state and local government are dealing with deficits, and some issuers are better than others," said Joe Darcy, head of municipals sector at Hartford Investment Management.

Darcy, who manages the Hartford Municipal Real Return Fund (HTNAX), said he's particularly comfortable with tax-backed general obligation bonds issued at the state level, citing a slow but steady return of sales and income tax revenues.

But investors should proceed with caution. States like Illinois and California continue to make headlines over their budget troubles so those may not be the best bets.

"Investors need to be selective, and need to watch out for states with particularly high unemployment, low unemployment growth and the ones that make the news for political budget battles," warned Richard Ciccarone, managing director and chief research officer at McDonnell Investment Management.

On the local level, experts are big fans of revenue bonds issued for essential services, such as electric power, or water or sewer systems, since they provide reliable income streams and are often of high credit quality.

"Whether the economy goes up, down or sideways, people have a need for services like clean water, so people will pay for those essential services," said Darcy of Hartford Investment Management.

That's largely why the BlackRock National Municipal fund (MDNLX) is overweight in bonds secured by essential service tax revenues, said Peter Hayes, the head of BlackRock's municipal bonds group.

Ultimately, the safest bet for investors seeking exposure to munis may lie with mutual funds and exchange traded funds.

"Those types of products pay close attention to credit quality for you and are diversified since they are professionally managed," said Jim Colby, senior municipal bond strategist at Van Eck Global, which offers the Market Vectors family of ETFs that includes the Short Municipal Index ETF (SMB), the Intermediate Municipal Index ETF (ITM) and the Long Municipal Index ETF (MLN).

For mutual funds that boast a mix of highly-rated munis at low expense ratios, Standard & Poor's analyst Todd Rosenbluth recommends T. Rowe Price Summit Municipal Income Fund (PRINX), the Dreyfus AMT-Free Muni Bond Fund (DRMBX) or the Fidelity Intermedial Muni Income Fund (FLTMX).

"We've found that these funds outperform their peers and control risk from both a credit perspective and a duration perspective," Rosenbluth said.

Why munis? The big attraction of muni bonds over Treasuries lies with the tax-free structure. Many munis are exempt from federal taxes and often from state and local taxes as well.

Treasury yields historically outperform muni yields but recently it's been the reverse and that's making munis more attractive.

Treasury yields have been abysmal, as the 'flight to safety' play has pushed Treasury prices sky high and yields very low. The 10-year yield has hovered around 3.5% for months.

"Both muni bonds and Treasuries are considered to be low-risk investments, but the yields on high-quality muni bonds are more appealing in comparison," said Rob Williams, director of income planning at Charles Schwab.

For example, a AA-rated 10-year general obligation municipal bond currently yields a tax-free 3.54%, according to Thomson Reuters' Municipal Market Data. That's on par with the 10-year Treasury note.

But here's where investors win with munis.

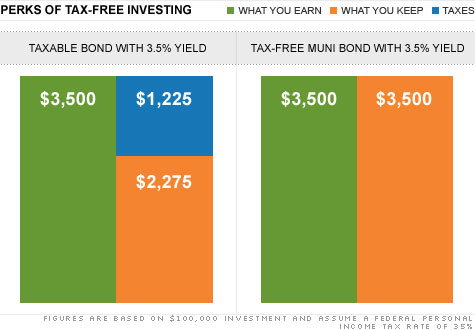

Both securities would deliver a $3,500 return, based on a $100,000 initial investment, based on a 3.5% yield.

However, an investor who falls in the 35% federal tax bracket would only get $2,275 because of the tax bill, while a muni investor would get the entire return, free of tax. The taxable bond would need to yield at least 5.4% to match the lower yielding, but tax-free, bond. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |